3 High-Yielding TSX Dividend Stocks With Yields Starting At 3.6%

Amidst a backdrop of cautious interest rate cuts by the Bank of Canada and a pause from the Federal Reserve, Canadian consumers are navigating an economic landscape marked by both burgeoning household wealth and increasing financial pressure on lower-income groups. As consumer sentiments show signs of strain despite strong market indices and ongoing economic expansion, investors might consider the stability offered by high-yielding TSX dividend stocks, which can provide consistent returns in such fluctuating conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.86% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.41% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.50% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.62% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.46% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.00% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.63% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.45% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.33% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.32% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

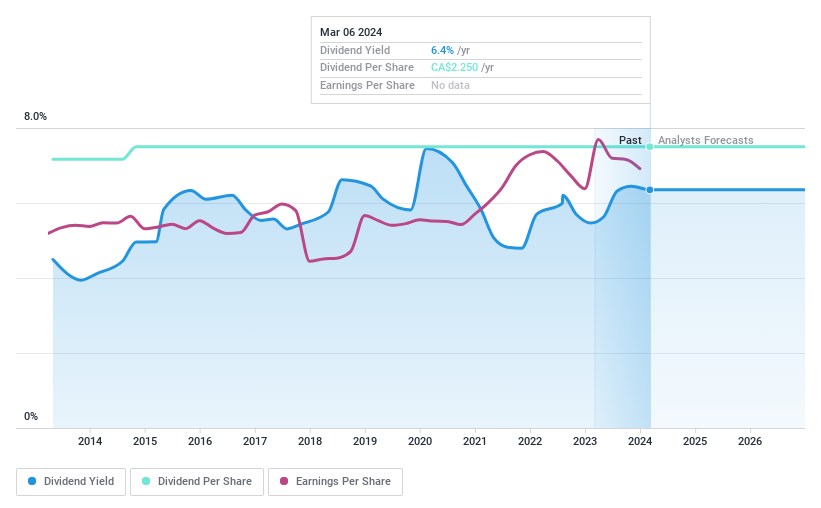

IGM Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market capitalization of approximately CA$9.06 billion.

Operations: IGM Financial Inc. generates its revenue primarily through two segments: Asset Management, which brought in CA$1.19 billion, and Wealth Management, contributing CA$2.26 billion.

Dividend Yield: 5.9%

IGM Financial's dividend yield of 5.89% is below the top tier in the Canadian market, yet its dividends are well-supported with a payout ratio of 69.5% and a cash payout ratio of 75%, indicating stability from earnings and cash flows respectively. Dividends have shown growth over the past decade, underscoring reliability despite recent financial setbacks in Q1 2024, where revenue and net income fell to CA$811.67 million and CA$223.39 million respectively from higher figures last year.

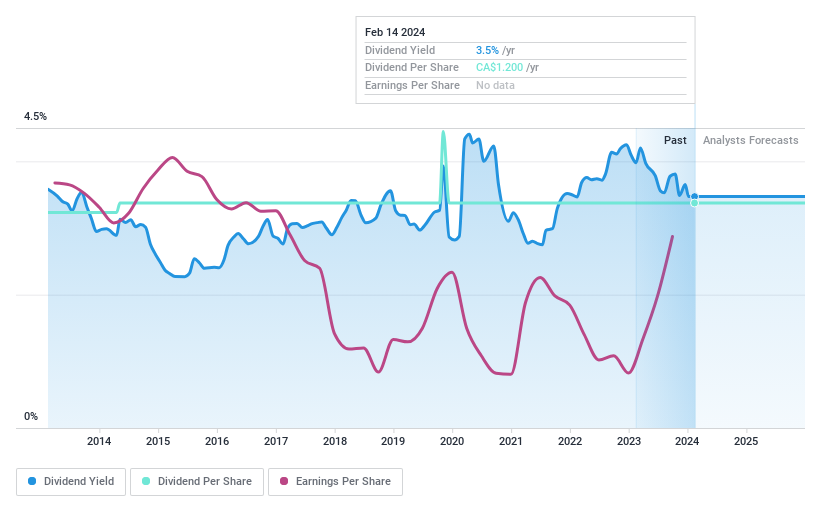

K-Bro Linen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services primarily to healthcare institutions and hotels, with a market capitalization of approximately CA$340.51 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue from its laundry and linen services provided to the healthcare and hospitality sectors.

Dividend Yield: 3.7%

K-Bro Linen has maintained a consistent dividend, with a current yield of 3.68%, which is lower than the top Canadian dividend payers. The dividends are sustainable, backed by a payout ratio of 73.2% and a cash payout ratio of 38.5%, indicating strong coverage by both earnings and cash flows. Recent activities include ongoing share repurchases, enhancing shareholder value, and a newly secured CA$175 million credit facility to support operations and potential growth initiatives.

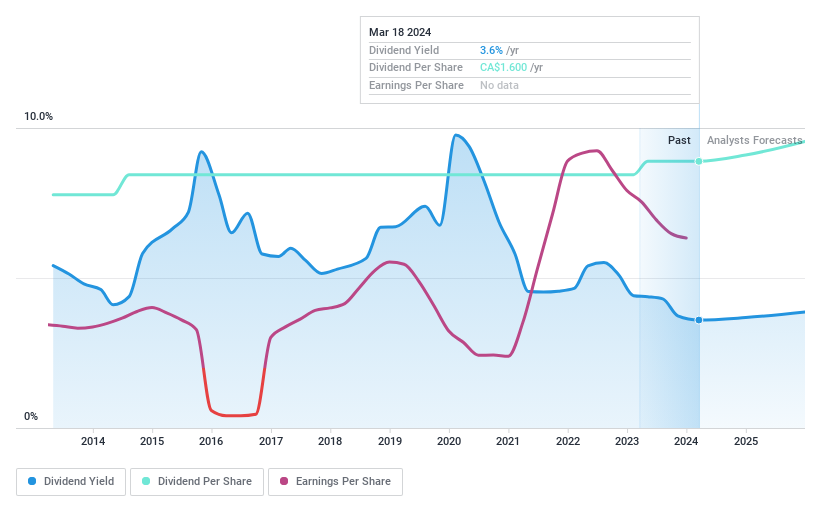

Russel Metals

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company operating in Canada and the United States, with a market capitalization of approximately CA$2.16 billion.

Operations: Russel Metals Inc. generates revenue through three primary segments: Steel Distributors with CA$429 million, Energy Field Stores at CA$982.20 million, and Metals Service Centers contributing CA$2.95 billion.

Dividend Yield: 4.6%

Russel Metals, trading 15.5% below its estimated fair value, offers a stable dividend yield of 4.63%, which is lower than the top quartile in Canada at 6.61%. The dividends have shown growth and stability over the past decade, supported by a low payout ratio of 40.3% and a cash payout ratio of 31.8%, ensuring sustainability from both earnings and cash flow perspectives. Recent developments include a strategic acquisition set to close in Q3 2024 and a modest increase in quarterly dividends to CA$0.42 per share as of June 2024, reflecting ongoing financial health despite a recent dip in quarterly earnings and sales.

Next Steps

Click through to start exploring the rest of the 30 Top TSX Dividend Stocks now.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:IGM TSX:KBL and TSX:RUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance