3 High Yielding German Dividend Stocks With Minimum 6.2% Return

The German market, much like other global markets, has been experiencing a series of ups and downs recently. Amidst these fluctuations, high-yielding dividend stocks have emerged as an attractive investment avenue for those seeking stable income streams. These stocks can be particularly beneficial in the current economic climate where traditional income sources are under pressure due to factors such as inflation and geopolitical tensions. However, it's crucial to assess the company's financial health and dividend sustainability before investing. In this article, we will discuss three German dividend stocks that offer a minimum return of 6.2%.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.30% | ★★★★★★ |

FORTEC Elektronik (XTRA:FEV) | 3.63% | ★★★★★☆ |

PWO (XTRA:PWO) | 5.36% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 5.43% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.33% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 6.95% | ★★★★★☆ |

Bayerische Motoren Werke (XTRA:BMW) | 5.47% | ★★★★★☆ |

Nordwest Handel (DB:NWX) | 4.76% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.25% | ★★★★★☆ |

K+S (XTRA:SDF) | 5.08% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

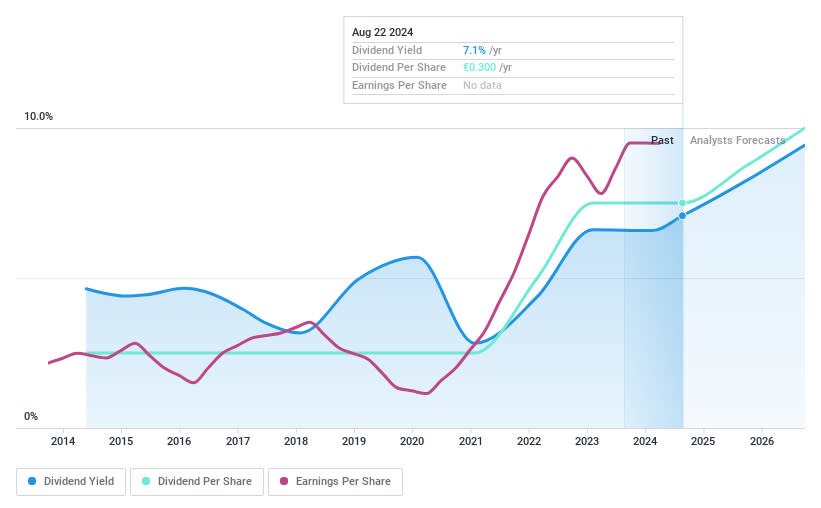

Edel SE KGaA

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA is a European-based independent music company with a market capitalization of approximately €1.01 billion.

Operations: Edel SE & Co. KGaA generates its revenue primarily from two segments: Marketing and Sales, which brings in €135.56 million, and Manufacturing and Logistics, contributing €144.67 million to the company's income stream.

Dividend Yield: 6.3%

Edel SE KGaA (EDL) offers an attractive and reliable dividend yield of 6.3%, considerably higher than the top 25% of dividend payers in the German market. The company's dividends have shown stability and growth over the past decade, with a reasonable payout ratio of 52.6% indicating coverage by earnings and cash flows. Despite trading at a significant discount to its estimated fair value, EDL carries high debt levels which may impact future payouts. Recent earnings results reveal a modest growth of 4.9% over the past year.

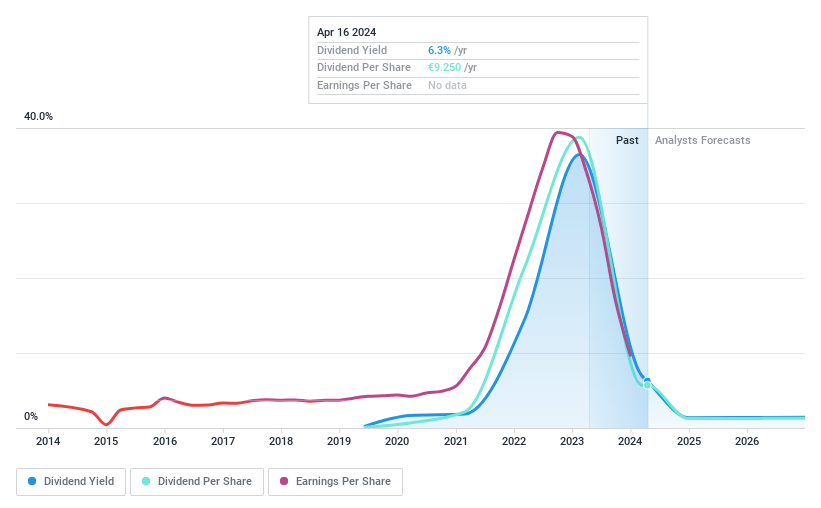

Hapag-Lloyd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hapag-Lloyd Aktiengesellschaft is a global liner shipping company, with its subsidiaries operating worldwide, and it has a market capitalization of €26.01 billion.

Operations: Hapag-Lloyd Aktiengesellschaft generates its revenue primarily from two segments: Liner Shipping, which contributes €17.76 billion, and Terminal & Infrastructure with a contribution of €187.1 million.

Dividend Yield: 6.2%

Hapag-Lloyd's dividend yield of 6.25% positions it in the top 25% of German market dividend payers. Despite a volatile track record, the company's dividends are covered by earnings and cash flows, with payout ratios of 55.4% and 49.8%, respectively. However, Hapag-Lloyd recently proposed a decrease in dividends to €9.25 per share for a total payout of €1.6 billion for 2023, following a year marked by reduced sales and net income compared to previous figures.

Get an in-depth perspective on Hapag-Lloyd's performance by reading our dividend report here.

Our valuation report unveils the possibility Hapag-Lloyd's shares may be trading at a premium.

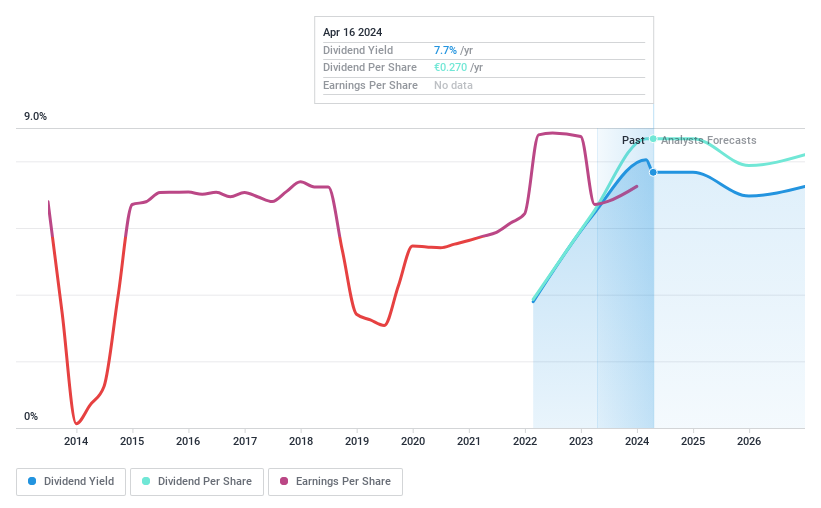

MPC Münchmeyer Petersen Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager, with a market capitalization of approximately €124.07 million.

Operations: MPC Münchmeyer Petersen Capital AG, a publicly owned investment manager, generates its revenue primarily from three segments: Miscellaneous at €0.38 million, Management Services at €30.53 million, and Transaction Services at €7.04 million.

Dividend Yield: 7.7%

MPC Münchmeyer Petersen Capital's dividend yield of 7.67% ranks in the top quartile of German market payers. Despite an unstable history, its dividends are supported by earnings and cash flows with payout ratios of 72.6% and 73.6%, respectively. However, the firm has only distributed dividends for two years, limiting its reliability as a consistent payer. The company's recent full-year results revealed a decrease in net income to €13.1 million from €25.99 million the previous year, impacting earnings per share which fell to €0.37 from €0.74.

Taking Advantage

Delve into our full catalog of 28 Top Dividend Stocks here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:EDL XTRA:MPCK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance