3 High Yield Dividend Stocks On Euronext Amsterdam With Up To 9.9% Yield

Amid a backdrop of fluctuating global markets, the Euronext Amsterdam continues to present opportunities for investors seeking stable returns through high-yield dividend stocks. As inflation concerns moderate and central banks adjust their policies, dividend-paying companies in stable sectors become increasingly attractive for those looking to generate consistent income from their investments.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.53% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.46% | ★★★★☆☆ |

Van Lanschot Kempen (ENXTAM:VLK) | 9.93% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.48% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.33% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.68% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

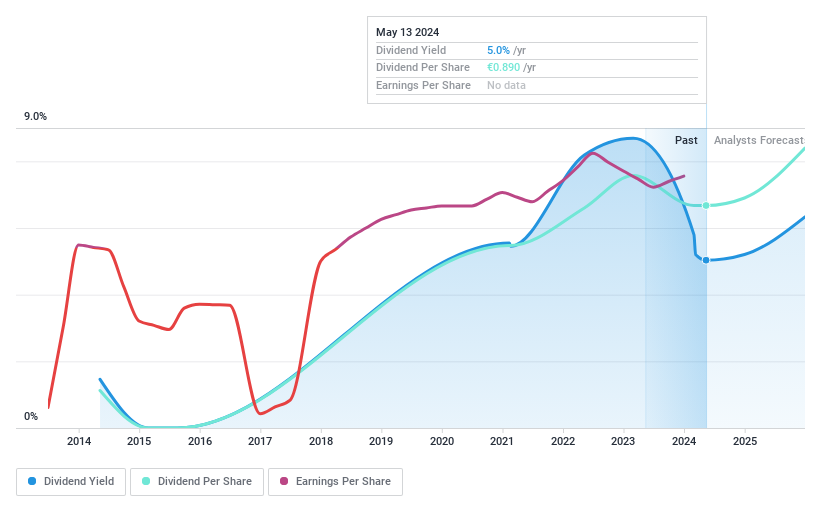

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands, with a market capitalization of approximately €510.23 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate segment (€411.79 million), Van Wanrooij division (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology sector (€1.08 billion).

Dividend Yield: 4.7%

Koninklijke Heijmans reported a revenue increase to €2.12 billion in 2023 from €1.81 billion the previous year, maintaining net income at €60 million. Despite a stable payout ratio of 37.1% and cash payout ratio of 59%, its dividend yield at 4.68% trails the Dutch market's top quartile by over 0.8%. The company's dividends, while covered by earnings and cash flow, have shown volatility and inconsistency over the past decade, reflecting a potentially unstable dividend track record despite recent growth in payments.

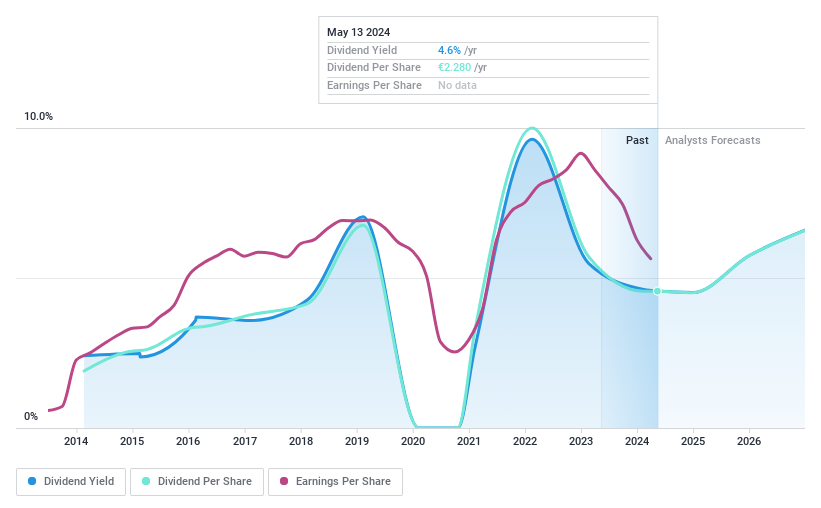

Randstad

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering a range of work and human resources services, with a market capitalization of approximately €9.01 billion.

Operations: Randstad N.V. operates primarily in the field of work and human resources services.

Dividend Yield: 4.5%

Randstad N.V. experienced a decrease in Q1 2024 sales to €5.94 billion from €6.52 billion year-over-year, with net income also falling to €88 million from €154 million. Despite this, the firm maintains a sustainable dividend framework, supported by a payout ratio of 73.4% and cash payout ratio of 45.9%. However, its dividend yield at 4.48% is below the top Dutch payers and its decade-long dividend history shows instability and unreliability in payments, raising concerns about future consistency despite recent share buybacks totaling €316.66 million.

Click here to discover the nuances of Randstad with our detailed analytical dividend report.

The valuation report we've compiled suggests that Randstad's current price could be quite moderate.

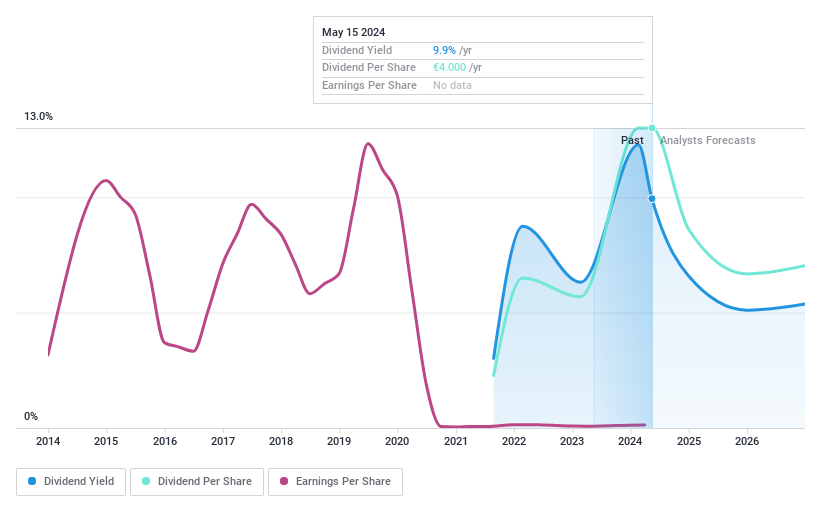

Van Lanschot Kempen

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV, operating both in the Netherlands and internationally, offers a range of financial services with a market capitalization of approximately €1.70 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily through its Investment Banking Clients and Wholesale & Institutional Clients segments, contributing €41 million and €83.10 million respectively.

Dividend Yield: 9.9%

Van Lanschot Kempen, while relatively new to dividend payments with less than a decade of history, offers a promising 9.93% yield, placing it in the top quartile of Dutch dividend payers. The firm's dividends are well-supported by earnings with a current payout ratio of 70.9% and an anticipated coverage in three years at 66.6%. Despite this strength, shareholder dilution occurred over the past year and its dividend track record is considered unstable. Recent activities include a proposed dividend increase to €2 per share for 2023 and the redemption of €100 million in Tier 1 notes, showcasing proactive financial management.

Next Steps

Navigate through the entire inventory of 6 Top Euronext Amsterdam Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:HEIJM ENXTAM:RAND and ENXTAM:VLK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance