3 High Yield Dividend Stocks On SGX With Up To 7.4% Yield

In recent developments, the Singapore market has shown resilience, adapting swiftly to technological advancements and changing consumer preferences. This dynamic environment underscores the importance of selecting stocks that not only offer high yields but also demonstrate stability and growth potential in current market conditions.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.01% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.49% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.80% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.70% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.48% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.91% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.05% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

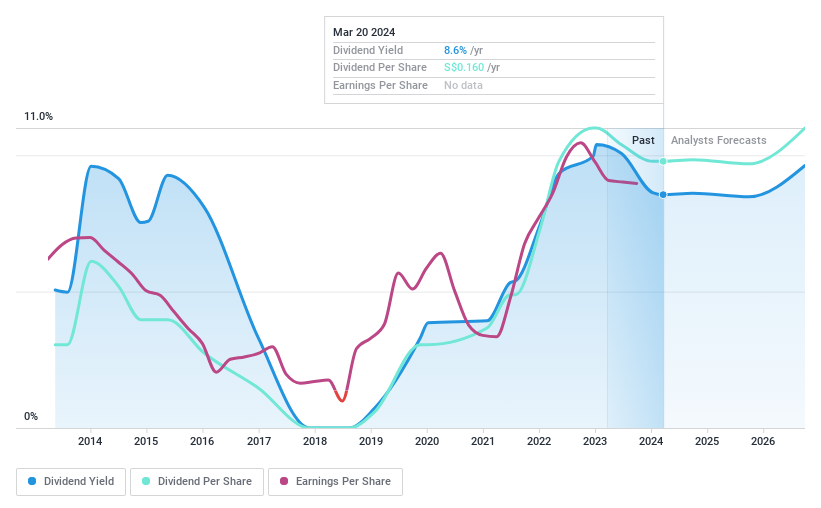

BRC Asia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally with a market capitalization of SGD 587.11 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which brought in SGD 413.27 million, and Fabrication and Manufacturing, which accounted for SGD 1.21 billion.

Dividend Yield: 7.5%

BRC Asia's dividend yield stands at S$7.48%, ranking in the top 25% in the Singapore market. Despite trading at 54.7% below its estimated fair value, BRC Asia has demonstrated a volatile dividend history over the past decade, with payments not consistently growing and experiencing significant fluctuations. However, dividends are well-supported financially, evidenced by a low payout ratio of 38% and a cash payout ratio of 28.1%, indicating that earnings and cash flows adequately cover distributions.

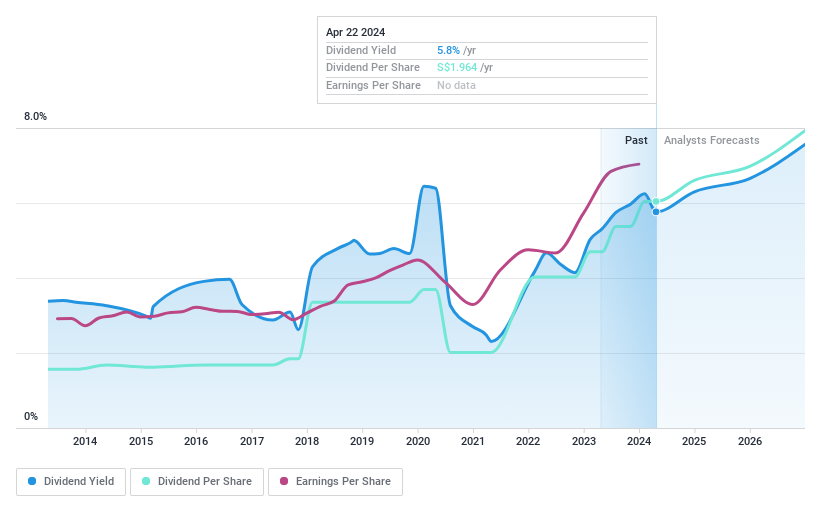

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and globally, with a market capitalization of approximately SGD 100.97 billion.

Operations: DBS Group Holdings Ltd generates its revenue primarily through commercial banking and financial services across various regions including Singapore, Hong Kong, Greater China, South and Southeast Asia, and other international markets.

Dividend Yield: 5.5%

DBS Group Holdings recently declared a quarterly dividend of S$0.54, maintaining its practice of regular payouts despite a history of volatile dividends over the past decade. The bank's net income rose to S$2.96 billion in Q1 2024, up from S$2.57 billion the previous year, supporting these distributions with a reasonable payout ratio of 50.8%. However, with significant insider selling and an unstable dividend track record, the reliability of future dividends could be concerning for investors seeking consistent income streams from their investments in Singapore's dividend stocks landscape.

Delve into the full analysis dividend report here for a deeper understanding of DBS Group Holdings.

Our valuation report here indicates DBS Group Holdings may be undervalued.

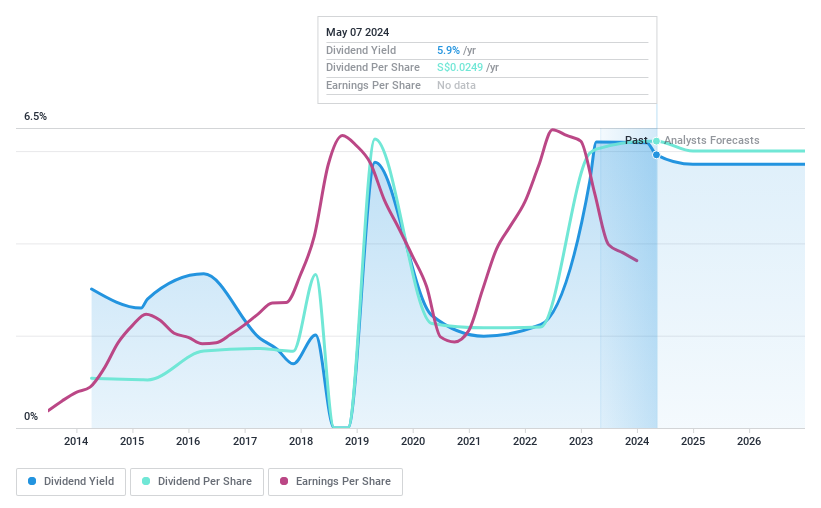

China Sunsine Chemical Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across the People’s Republic of China, other parts of Asia, the United States, and Europe, with a market capitalization of SGD 382.62 million.

Operations: China Sunsine Chemical Holdings Ltd. generates CN¥4376.14 million from Rubber Chemicals, CN¥221.29 million from Heating Power, and CN¥29.76 million from Waste Treatment in revenue segments.

Dividend Yield: 6.2%

China Sunsine Chemical Holdings recently announced a share buyback and declared dividends, including a special dividend, reflecting its commitment to returning value to shareholders. Despite these positive moves, the company's dividend yield of 6.16% is slightly below the top tier in Singapore's market. Its dividends have shown volatility over the past decade but are supported by low payout ratios from earnings (20.8%) and cash flow (30.2%), suggesting sustainability despite past irregularities and a challenging profit margin environment compared to the previous year.

Make It Happen

Delve into our full catalog of 21 Top SGX Dividend Stocks here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BEC SGX:D05 and SGX:QES.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance