3 High Insider Ownership Japanese Stocks With Earnings Growth Up To 47%

Amidst a generally stable performance in the Japanese stock market, with the Nikkei 225 Index seeing a modest gain, investors may find particular interest in companies where insiders hold significant stakes. High insider ownership can often signal strong confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 26.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.9% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 91.1% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 54.1% |

freee K.K (TSE:4478) | 24% | 81% |

Let's take a closer look at a couple of our picks from the screened companies.

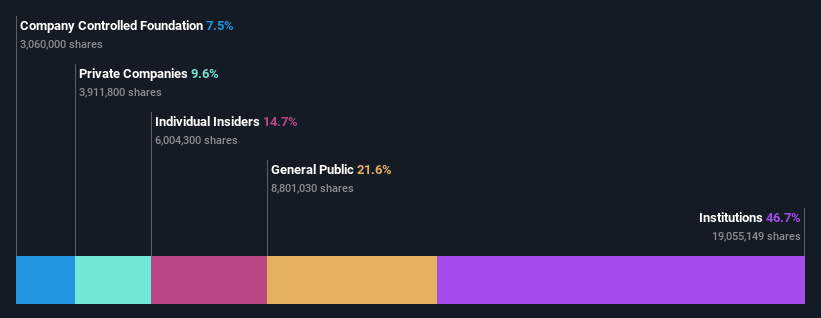

Qol Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qol Holdings Co., Ltd. operates a network of dispensing pharmacies and provides business process outsourcing services in Japan, with a market capitalization of approximately ¥54.19 billion.

Operations: The company generates ¥16.52 billion from its dispensing pharmacies and ¥0.15 billion from business process outsourcing services.

Insider Ownership: 14.5%

Earnings Growth Forecast: 29.4% p.a.

Qol Holdings, a Japanese company, is trading at 75.8% below its estimated fair value, signaling potential undervaluation. The firm's revenue is expected to increase by 13.7% annually, outpacing the broader Japanese market's growth of 4.1%. Additionally, earnings are projected to surge by 29.36% per year. However, its Return on Equity is anticipated to be modest at 17% in three years. Despite these promising financial metrics, the company has experienced high share price volatility recently and pays a stable dividend of 2.34%.

JTOWER

Simply Wall St Growth Rating: ★★★★☆☆

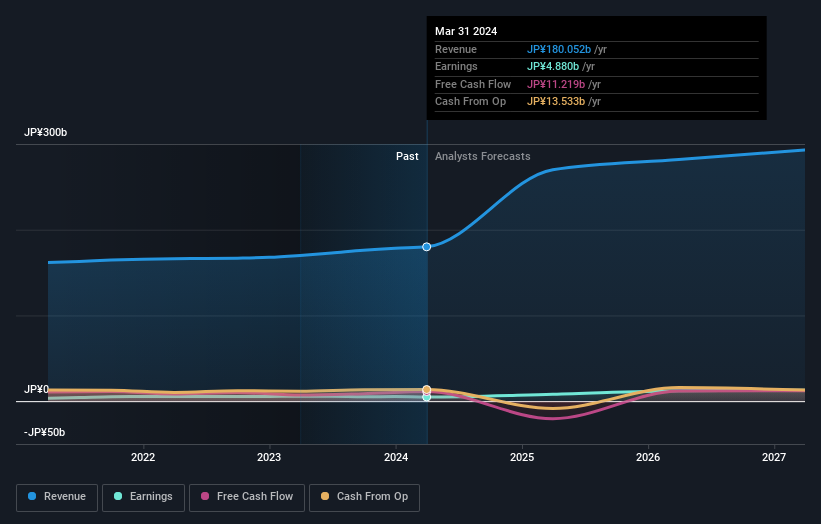

Overview: JTOWER Inc. specializes in infrastructure sharing services across Japan, with a market capitalization of approximately ¥44.17 billion.

Operations: The company generates its revenue through infrastructure sharing services across Japan.

Insider Ownership: 26%

Earnings Growth Forecast: 47.9% p.a.

JTOWER is poised for notable financial shifts, with expectations of turning profitable within three years and a revenue growth forecast at 19.7% annually, surpassing Japan's market average. Despite this, shareholder dilution occurred over the past year and the company's Return on Equity is projected to remain low at 2%. Additionally, recent strategic adjustments include discontinuing a development project with Foxconn due to delays and shifting focus towards more immediately demanded infra-sharing solutions for 5G technologies.

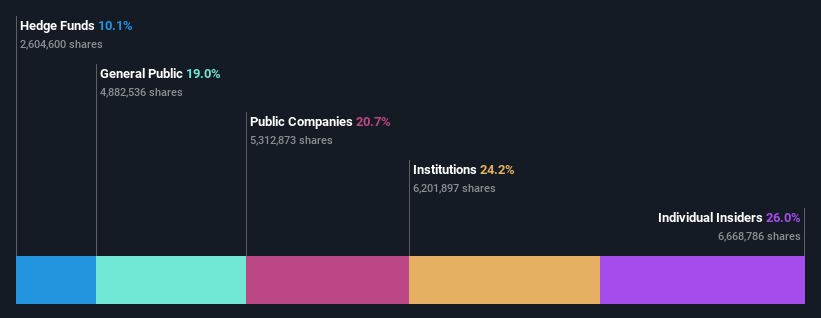

en-japan

Simply Wall St Growth Rating: ★★★★☆☆

Overview: en-japan inc. operates in providing human resources services both in Japan and internationally, with a market capitalization of approximately ¥103.47 billion.

Operations: The company generates revenue primarily from its human resources services, totaling approximately ¥67.66 billion.

Insider Ownership: 14.7%

Earnings Growth Forecast: 16.8% p.a.

en-japan inc. is set to achieve a robust financial performance with expected net sales reaching JPY 73 billion and an operating income of JPY 8.1 billion by March 2025. Despite a consistent dividend payout, the dividend coverage by cash flows remains weak. The company's revenue growth rate at 8% annually outpaces the Japanese market average, yet its earnings growth, while solid at approximately 16.8% annually, does not classify as very high compared to extreme growth benchmarks. Insider trading activity has been neutral recently, indicating no significant insider buying or selling trends that could signal strong internal confidence or concerns.

Click to explore a detailed breakdown of our findings in en-japan's earnings growth report.

Our valuation report unveils the possibility en-japan's shares may be trading at a premium.

Make It Happen

Unlock our comprehensive list of 100 Fast Growing Japanese Companies With High Insider Ownership by clicking here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3034TSE:4485 TSE:4849

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance