3 Elite Chinese Internet Stocks Pulling Back to Support

Leadership Potential

Over the past three months, Chinese-based internet stocks have been amongst the strongest in the market. The KraneShares CSI China Internet ETF KWEB is amongst the most followed Chinese ETFs in the United States. Before pulling back recently, the KWEB ETF had more than doubled since making dramatic lows in late October 2022.

Image Source: Zacks Investment Research

Because of the abrupt and unrelenting rally off the lows, investors who blinked or had doubt sowed into their minds about Chinese-related names likely missed the move. However, after a recent pullback in these leaders, they may offer investors a second chance.

All Pullbacks are Not Created Equal

There are subtle attributes for investors to know about when sizing up the risk to reward the potential of a pullback, including:

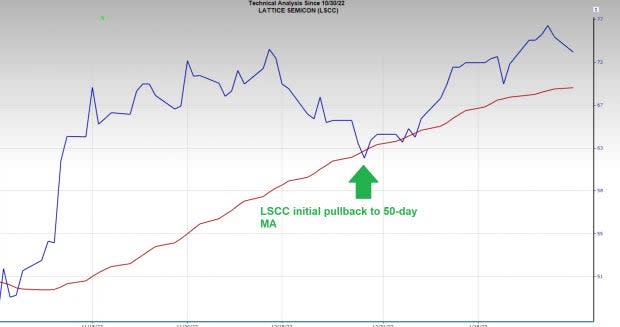

1. Early Pullbacks Offer Attractive Risk to Reward: Often, the initial pullback to the 50-day moving average in a trend offers investors the most optimal buy zone. As a trend ages and gets longer in the tooth, the number of times you can “go back to the cookie jar” decreases. Chip maker Lattice Semiconductor LSCC is a prime example.Recently, the stock pulled back to its 50-day moving average for the first time and found support before taking off again.

Image Source: Zacks Investment Research

2. Power and Distance are Correlated: When it comes to the stock market, strength tends to beget strength. In other words, the stronger the price trend into the first pullback, the further the trend is likely to continue.

3. Surprises Tend to Happen in the Direction of the Trend: Stocks in bullish trends tend to remain in bullish trends more often than not. For example, a stock trending strongly into earnings is more likely to gap up than down following the release of results – with all else equal.

Chinese Internet Names Offer Pullback Buyers a Second Chance

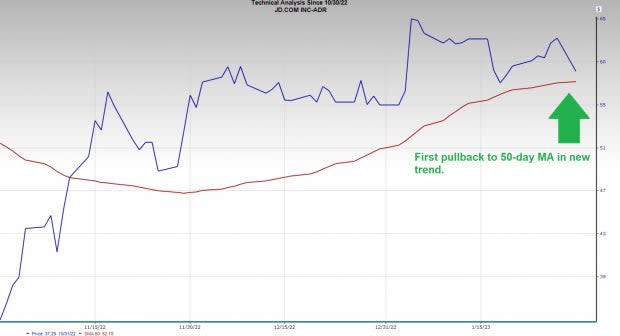

Investors who missed the gigantic moves in Chinese internet stocks over the past few months are getting a pullback opportunity. Three of the strongest names include Alibaba BABA, JD.com JD, and Vipshop VIPS. Each stock has more than doubled off last year’s lows, holds a Zack’s Strong Buy Rating, and is pulling into the 50-day moving average for the first time in this trend.

Image Source: Zacks Investment Research

Bargain Basement Valuations

The technical picture is not the only positive attribute these stocks have. Following the multi-year pullback in these stocks, valuations are getting much more attractive. For example, from a P/E perspective, BABA shares are at their most attractive levels since inception.

Image Source: Zacks Investment Research

Pictured: BABA P/E ratio since inception.

Analysts are Bulled Up

Judging by consensus estimates, analysts believe that the earnings momentum is just starting from a growth perspective. For instance, in the past 60 days, consensus analyst estimates for JD’s Q2 earnings have risen by 25%.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

KraneShares CSI China Internet ETF (KWEB): ETF Research Reports

Yahoo Finance

Yahoo Finance