These 3 Companies are Cash-Generating Machines

Strong cash flows reflect financial stability, allowing companies to pay down debt, pursue growth opportunities, and shell out dividend payments. And for those interested in investing in strong cash flows, three companies – Exxon Mobil XOM, Microsoft MSFT, and Visa V – are all cash-generating machines.

These companies are also better equipped to weather an economic downturn, providing another beneficial advantage for investors from a long-term standpoint. Let’s take a closer look at each.

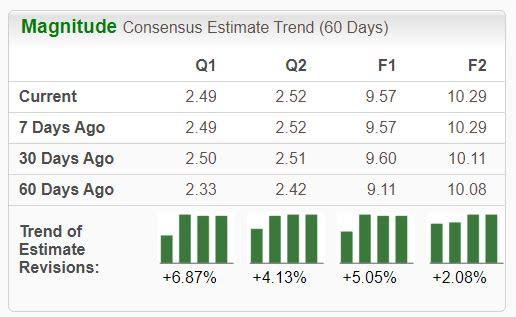

Exxon Mobil: Share Return Up 16% This Year

Energy titan Exxon Mobil has seen its earnings outlook shift positively across the board, with shares delivering a +16% return year-to-date. Higher oil prices have aided the move, with quarterly results also providing some positivity.

Image Source: Zacks Investment Research

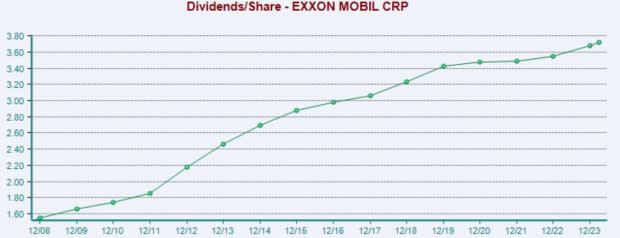

The company continued its cash-generating nature throughout its latest period, reporting $10.1 billion in free cash flow. Reflecting its shareholder-friendly nature, XOM paid out $3.8 billion in dividends throughout the period.

Exxon has consistently increasingly rewarded its shareholders, as we can see illustrated below.

Image Source: Zacks Investment Research

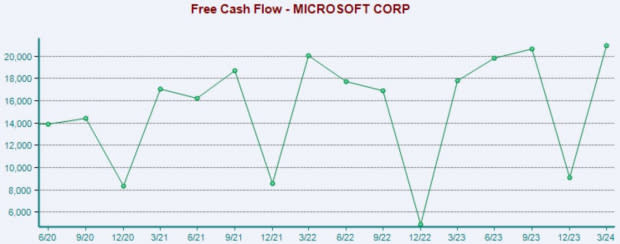

Microsoft: Cloud Revenue Jumps 23% YOY

A notable member of the beloved ‘Mag 7’ group, Microsoft shares have primarily traded alongside the S&P 500 in 2024, gaining +12%. Like XOM, better-than-expected quarterly results have pushed life into shares, beating expectations all year long so far.

The revisions trend has been particularly bullish for its current fiscal year, up 9% over the last year and suggesting a 20% climb year-over-year. Recent cloud strength has analysts optimistic, with the company expected to benefit nicely from AI.

Cloud revenue popped 23% year-over-year throughout its latest period.

Image Source: Zacks Investment Research

Free cash flow throughout the period totaled $20.1 billion, increasing 17% from the same period last year. Cash from operations was reported at $31.9 billion, again well above the $24.4 billion mark last year.

Image Source: Zacks Investment Research

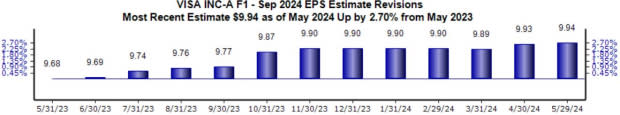

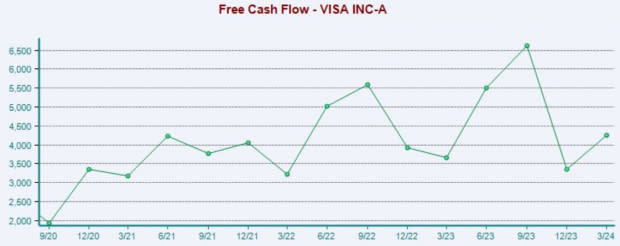

Visa: Free Cash Flow up 16%

Visa shares have lagged in 2024, gaining +4.5% in value compared to a 12% gain from the S&P 500. Quarterly releases have kept the sellers at bay, with Visa exceeding both consensus earnings and revenue expectations in 10 consecutive releases.

The company has enjoyed positive earnings estimate revisions for its current fiscal year, with the $9.94 Zacks Consensus EPS estimate up nearly 3% over the last year.

Image Source: Zacks Investment Research

The company continues to execute, with 8% year-over-year payments volume growth reflecting steady consumer spending. Processed transactions improved by 11% from the same period last year, with net cash from operations also seeing a modest improvement.

Free cash flow totaled $4.2 billion, up 16% from last year’s mark.

Image Source: Zacks Investment Research

Bottom Line

Companies boasting strong cash-generating abilities can be great investments, as they have plenty of cash to fuel growth, pay out dividends, and easily wipe out debt. And as mentioned above, these companies are better equipped to handle an economic downturn, undeniably a positive.

For those seeking cash-generators, all three above – Exxon Mobil XOM, Microsoft MSFT, and Visa V – fit the criteria nicely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance