3 Buy-Ranked Stocks That Popped Last Week

It is still earnings season. So in normal circumstances, this would mean that some companies would report above expectations, analysts would raise their estimates on these stocks and more investors would pile into them. This is a pattern we’ve seen time and again, and it doesn’t often go any other way.

Except this year. And the recent years actually, since the pandemic hit. Because things just aren’t moving as they should.

The overall picture is clear enough. We had a pandemic induced slump followed by an immediate bounce-back and then a gradual recovery, meaning difficult comps and slowing growth.

But the recovery seems to be dragging on forever, as a whole range of other issues enter the scene. Inflation is the hottest topic of all and the Fed is determined to do what it takes to get that down. Clearly, we’ve had enough free money and now it’s time to pay the piper.

So investors aren’t responding as you’d normally expect to strong results. They’re looking at overall prospects much more these days. And that’s why the three stocks I’ve picked here aren’t necessarily earnings stories. Although of course there’s that angle too, and the relates estimate revisions trend:

Ryder System, Inc. R

Miami, Florida-based Ryder System is a logistics and transportation company with global operations. Its fleet management services include leasing, supplies, vehicle maintenance and rental, used vehicle sales, fuel planning and management, tax reporting, etc.

Its supply chain solutions include distribution management services like coordinated warehousing and just-in-time component replenishment, as well as transportation management services like shipment optimization, load scheduling, delivery confirmation, etc.

It also offers e-commerce and last mile services. Apart from this, it also offers some dedicated transportation services including equipment, maintenance, drivers, administrative, and additional services, etc.

While the 14.6% increase in Ryder share prices over the past week is related to its unsolicited takeover offer from private equity firm HG Vora Capital Management, which offered a 20% premium to its closing share price on Thursday, this is a solid bet even if the deal falls through.

That’s because this Zacks Rank #1 (Strong Buy) stock with Value, Growth and Momentum scores of A, B and C, respectively has reported solid results of late, which along with the estimate revisions trend, indicates very strong growth potential for the company.

Ryder also belongs to the Transportation - Equipment and Leasing industry, which is in the top 28% of 250+ Zacks-ranked industries. And our analysis of historical periods tells us that a company with a buy rank and belonging to the top 50% of industries stands a good chance of seeing its share price appreciate.

As far as the numbers are concerned, Ryder topped revenue and earnings estimates by a respective 10.7% and 50.8%. Its average surprise in the last four quarters is 48.2%. The Zacks Consensus Estimate for 2022 is up $1.79 (15.3%) in the last 30 days. Revenue and earnings are expected to grow 18.5% and 40.8% this year.

Ryan Specialty Group Holdings, Inc. RYAN

Chicago, Illinois-based Ryan Specialty Group is a service provider of specialty products and solutions for insurance brokers, agents and carriers. It offers distribution, underwriting, product development, administration and risk management services by acting as a wholesale broker and a managing underwriter.

The Zacks Rank #2 (Buy) stock with Value, Growth and Momentum Scores of D, A and C, respectively is up 10.4% in the past week. It belongs to the Insurance – Brokerage industry (top 33%).

In the recently announced earnings report, Ryan Specialty posted an earnings beat of 14.3% on sales that beat by 3.9%. Market expansion, innovative solutions and efficient client servicing allowed the company to deliver 20% organic growth while maintaining solid margins and continuing to invest in enhancement of the Ryan Specialty platform. Hiring activity also remains strong as it continues to build its broker team.

In response to the strong results, analysts have also raised their estimates. The 2022 estimate is now up 3 cents (2.5%). Analysts currently expect revenue and earnings growth of 19.0% and 13.0%, respectively.

O-I Glass, Inc. OI

Perrysburg, Ohio-based O-I Glass manufactures and sells glass containers to food and beverage manufacturers primarily in the Americas, Europe and the Asia Pacific. Other than the alcoholic beverage market where its glass containers are used for bottling beer, flavored malt beverages, spirits and wine, they are used for packaging various food items like soft drinks, tea, juices, and also pharmaceuticals.

It also offers other glass containers in a range of sizes, shapes and colors. Products are sold directly to customers under annual or multi-year supply agreements, as well as through distributors.

O-I Glass is in the process of exiting non-core businesses and optimizing its asset base. In the recent past, the company completed the sale and lease back of its Brampton, Ontario plant for CAD $244 million. The company announced that it had already generated $1.3 billion of its $1.5 billion targeted proceeds by 2024 and was therefore likely to hit the target by year end, two years ahead of schedule. This announcement has sent its shares up 11.0% in the past week.

Earlier, the company also reported very strong results with sales growing 12.8% to beat the Zacks Consensus Estimate by 9.7%. Earnings grew 60% to beat the consensus by 36.6%. Analysts responded as expected, raising their 2022 estimates by 13 cents (6.8%). They currently expect revenue and earnings growth of 5.4% and 11.5%, respectively.

The Zacks Rank #2 stock with Value, Growth and Momentum Scores of A, C and D, respectively belongs to the Glass Products industry (top 17%).

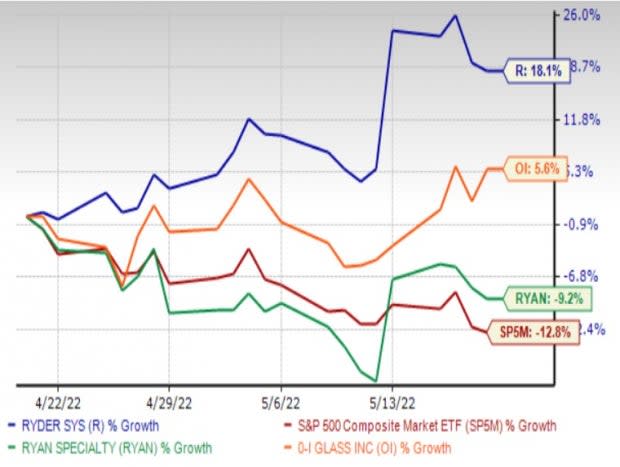

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

OI Glass, Inc. (OI) : Free Stock Analysis Report

Ryder System, Inc. (R) : Free Stock Analysis Report

Ryan Specialty Group Holdings, Inc. (RYAN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance