23andMe Holding (NASDAQ:ME) shareholders have endured a 41% loss from investing in the stock a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by 23andMe Holding Co. (NASDAQ:ME) shareholders over the last year, as the share price declined 41%. That falls noticeably short of the market decline of around 12%. We wouldn't rush to judgement on 23andMe Holding because we don't have a long term history to look at. Even worse, it's down 24% in about a month, which isn't fun at all.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for 23andMe Holding

Given that 23andMe Holding didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year 23andMe Holding saw its revenue grow by 18%. We think that is pretty nice growth. Meanwhile, the share price is down 41% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

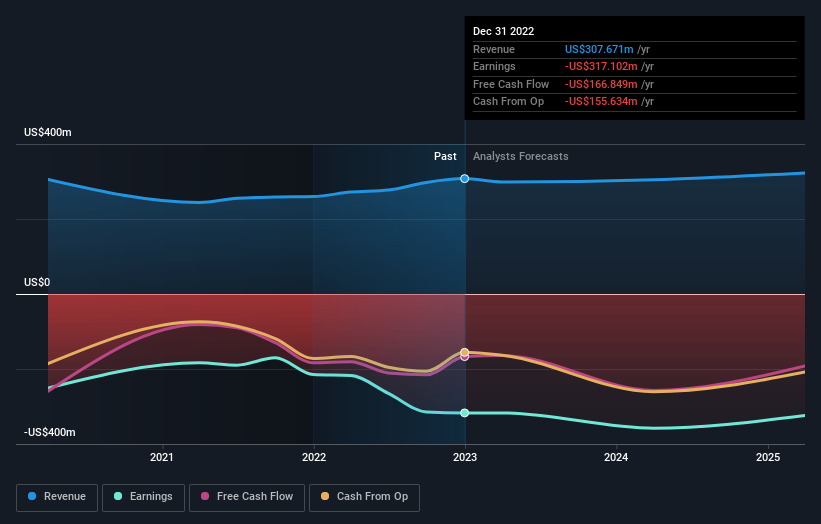

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

23andMe Holding shareholders are down 41% for the year, even worse than the market loss of 12%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 4.4% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for 23andMe Holding (1 shouldn't be ignored) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance