2 Semiconductor Stocks Beating Near-Term Uncertainty in Industry

Companies in the Semiconductor – General industry are at the forefront of the ongoing technological revolution based on HPC, AI, automated driving, IoT and so forth. These semiconductors also enable the cloud to function and help analyze the data into actionable insights that can be used by companies to operate more efficiently.

The pandemic hastened the ongoing digitization of every aspect of life. But this brought forward several years of investments, weakening the near-term outlook. The major end markets for semiconductors (excluding automotive) have been in a state of imbalance between demand and supply, a situation that hasn’t completely corrected.

With the bank crisis and financial tightening increasing economic uncertainties, it has become notably harder to predict the impact on this industry. This in spite of the fact that supply chains continue to adjust to increase reliability, build some inventory, reduce dependence on China, and onshore projects with national security implications. All these factors are contributing to the uncertainty and as a result, the valuation is also looking rich.

According to the latest data from the Semiconductor Industry Association (SIA), global semiconductor sales growth in 2022 was about 3.3%, reaching $574.1 billion. This was the highest annual sales ever. Although 2022 started off very strong, cyclicality and macro concerns combined to hurt performance toward the end of the year.

Both these factors remain in play through most of this year as well. Gartner’s expectations for 2023 reflect the same position. The research firm expects continued chip surplus through the current year to remain a pressure on prices, thereby hurting sales performance. It forecasts semiconductor revenue to decline 6.5% this year, more than the 3.6% decline predicted earlier.

While macro concerns are impacting near-term performance, the long-term outlook continues to favor strong growth due to auto electrification, structural changes in industrial automation, data center strength, and increased adoption of the cloud, AI, IoT, etc.

Right now, STMicroelectronics and NVIDIA Corporation may be worth considering.

About the Industry

This industry includes mostly semiconductor chip manufacturers like Intel Corp. (INTC).

Major Themes

The long-term outlook for the industry remains robust because of its being on the building-block side of technology, which makes it crucial for the proliferation of the Internet and the ongoing digitization of every aspect of life. The short-term outlook appears bleak, however. The pandemic had accelerated the move toward digitization, but it also created a lot of imbalances in demand and supply. The smartphone market for example (a primary application of semiconductors) is seeing issues on both the demand and the supply sides. Demand is affected by inflation while supply was affected by not only inflation but also geo-political tensions, China shutdowns and ongoing supply chain constraints. The other major chip consumer is the PC market, where the consumer and education segments remain soft following two years of very strong growth. Even enterprise deployment is slowing down because of concerns about economic growth. With global economies engaged in financial tightening, there is the concern that demand will weaken significantly before it picks up again toward the year-end. But even this outlook is uncertain because we don’t really know where the banking crisis and interest rate hikes will take the economy.

The good news is that some of the weakness in these traditional markets is being made good by strength in emerging areas like AI and machine learning, IoT, and automotive. ReportLinker expects the AI chip market to grow at a CAGR of 29.9% between 2022 and 2030. Driven by Internet connectivity across the developed and developing worlds and supportive technology such as sensor networks and AI adoption, the IoT market is also expected to grow steadily over the next few years. Future Market Insights expects the market to grow at a 5.3% CAGR between 2022 and 2032. Mordor Intelligence expects a stronger 14.7% CAGR between 2022 and 2027. Automotive electronics is another area of evolving needs with increasing electronics (including ADAS), safety enhancements and transition to electrified power trains being important drivers. Grand View Research estimates a 10.7% CAGR through 2025, which it attributes to awareness regarding energy-efficient lighting systems, as well as increasing sales of luxury vehicles that come fitted with navigation and infotainment systems. Automation and robotics, with increasing adoption across industrial operations, are other areas of growth. These strong end markets will drive continued demand for semiconductor components for years to come.

Semiconductor supply chains are adjusting. Semiconductor supply chains have become increasingly efficient over the years. While this has brought down cost, the just-in-time model has made the supply chains relatively unreliable in case of external disruptions, as happened during the pandemic, or when China imposed its zero tolerance COVID shutdowns. This, along with the recently-imposed restraints on dealing with China is leading semiconductor companies to diversify their supply chains and reduce their dependence on China. This is an ongoing process that will take several years. In the meantime, there is a growing concern that all the most important leading-edge chips are currently made in Taiwan, a country that China threatens to annex all the time. Since this has national security implications, there is an ongoing drive to onshore manufacturing. The $52 billion infusion from the CHIPS Act will help.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Semiconductor-General Industry is a stock group within the broader Zacks Computer and Technology Sector. It carries a Zacks Industry Rank #195, which places it in the bottom 22% of the 250 odd Zacks-classified industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates that near-term prospects aren’t too bright. Our research shows that the bottom 50% of the Zacks-ranked industries underperforms the top 50% by a factor of 1:2.

An industry’s positioning in the top 50% of Zacks-ranked industries is normally because the earnings outlook for the constituent companies in aggregate is relatively strong. The opposite is true for stocks in the bottom 50% of industries. In this case, the aggregate earnings estimate for 2023 is down 49.2% from the year-ago level. The aggregate earnings estimate for 2024 is down 27.1% from last year. The numbers have deteriorated significantly since July.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Stock Market Performance is Improving

Tracking the performance of the Zacks Semiconductor – General Industry over the past year shows that the industry has traded at a discount to both the broader Zacks Computer and Technology Sector and the S&P 500 index through most of the past year. It is only since November that the industry has pulled ahead.

The industry shed 12.4% of its value over the past year. The broader technology sector slid 16.5% while the S&P 500 index slid 14.3%.

One-Year Price Performance

Image Source: Zacks Investment Research

Current Valuation is Rich

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used multiple for valuing semiconductor companies, we see that the industry is currently trading at 43.52X, which is an 85.4% premium to its median value of 23.47X over the past year. Additionally, the S&P 500 trades at 17.83X while the sector trades at 22.68X. Therefore, the industry appears overvalued in all respects.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

2 Stocks Worth Considering

Given the many challenges related to demand and supply issues and the significant downward revisions in estimates through a good part of the past year, this is not an industry that can be recommended right now. At the same time, the industry consists of several technology heavyweights that are the backbone of how computing is done these days. Therefore, a closer look at a couple of Zacks #3 (Hold) rated stocks may be a good idea.

STMicroelectronics N.V. (STM): The company designs, develops, manufactures and markets a broad range of semiconductor integrated circuits and discrete devices used in a wide variety of microelectronic applications, including telecommunications systems, computer systems, consumer products, automotive products and industrial automation and control systems.

STMicroelectronics’s strength continues to come from the automotive and industrial verticals. In auto, it is coming from semiconductor pervasion, structural transformation and inventory replenishment. Management strategy remains focused on electrification, where its SiC MOSFET devices are enabling an increasing number of design wins. Industrial B2B is also strong, along with power, factory automation and robotics. Here too, STM is seeing considerable momentum. Given these positives and recent capacity additions, the company expects to grow revenue 4-10% in 2023.

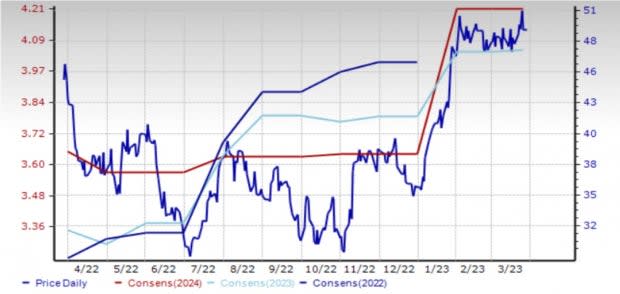

STM beat the Zacks Consensus Estimate by 16.8% in the last quarter. In the last 60 days, the current year EPS estimate of this Zacks Rank #3 stock increased 32 cents (8.6%). The 2024 estimate increased 83 cents (24.6%).

The shares of the company are up 9.6% over the past year.

Price & Consensus: STM

Image Source: Zacks Investment Research

NVIDIA Corporation (NVDA): Santa Clara, California-based NVIDIA Corporation provides graphics, and compute and networking solutions in the U.S., Taiwan, China and other markets. Its graphics processing units (GPUs) are the most popular in the gaming segment. NVIDIA is also at the leading edge of enterprise, data center, cloud and automotive deployments today.

The macro concerns are taking a toll on NVIDIA’s data center and gaming chips, although there has been some recovery on the gaming side. Significant inventory is hurting prices in these segments. Its exposure to the auto market is the biggest positive at this time because that market will continue to grow strongly over the next few years. Recent partnerships with Mercedes-Benz and Audi augers well in this respect. Moreover, the market is undersupplied, which means prices remain strong. Another positive is its strong position in AI and HPC markets, because that is an emerging market with tremendous prospects,

The Zacks Consensus Estimate for fiscal 2024 (ending January) is up 11 cents (2.5%) in the last 60 days and up 9 cents (1.5%) the following year.

The Zacks Rank #3 (Hold) stock is down 5.1% in the past year, although they have been rising steadily since the start of 2023.

Price & Consensus: NVDA

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance