2 Highly Ranked Finance Stocks to Buy with Generous Dividends

Among the coveted Zacks Rank #1 (Strong Buy) list, the financial sector is starting to stand out at the moment with 44 of these 230 highly ranked stocks being finance companies.

More intriguing, several of these top finance stocks have dividend yields over 3%, and here are two to consider.

Macro Bank BMA

As a leading bank in Argentina, Macro Bank checks in with a 4.89% annual dividend yield that towers over the S&P 500’s 1.36% average and tops the Zacks Banks-Foreign Industry average of 3.48%. Furthermore, inflation in Argentina has cooled to its lowest levels since 2022 and soaring EPS estimates reflect Macro Bank being a winner of a strengthening economic cycle with its stock climbing over +100% year to date but still trading at just 5X forward earnings.

Image Source: Zacks Investment Research

Morgan Stanley MS

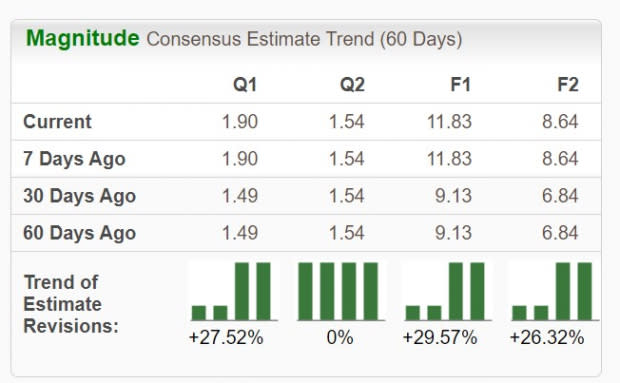

Favorable changes in the macroeconomic environment have strengthened Morgan Stanley’s outlook leading to increased probability for the leading financial investment services bank. With Morgan Stanley’s stock sitting on +2% gains this year more upside looks very likely as annual earnings are expected to climb 25% in fiscal 2024 to $6.83 per share versus $5.46 a share last year. Plus, FY25 EPS is projected to jump another 13% with MS trading at a reasonable 14X forward earnings multiple.

Image Source: Zacks Investment Research

The cherry on top, especially for longer-term investors is Morgan Stanley’s 3.55% annual dividend yield which tops its Zacks Financial-Investment Bank Industry average of 2.08%. Furthermore, Morgan Stanley's annualized dividend growth rate over the last five years is a very impressive 29.33% and its 59% payout ratio indicates there is plenty of room to increase its yield down the line.

Image Source: Zacks Investment Research

Bottom Line

Considering their generous dividends now appears to be an ideal time to buy these highly ranked finance stocks as they are benefiting from strong business environments. To that point, Macro Bank's Zacks Banks-Foreign Industry and Morgan Stanley's Financial-Investment Bank Industry are in the top 20% of almost 250 Zacks industries.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

Macro Bank Inc. (BMA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance