2 Dividend-Paying Transport Equipment & Leasing Stocks to Watch

The Zacks Transportation - Equipment and Leasing industry currently stands to benefit from the solid investor-friendly steps. Notably, consistent shareholder-friendly initiatives in the form of dividend payouts or share buybacks imply solid financial strength of companies in the Equipment and Leasing industry. Such moves boost investors’ confidence and positively impact the bottom line.

Notably, the industry has risen 37% compared with the Zacks S&P 500 Composite’s northward movement of 25.6% and the Zacks Transportation sector’s growth of 1.9%, over the past year.

Image Source: Zacks Investment Research

The buoyancy in the industry is further confirmed by its Zacks Industry Rank #56, which places it in the top 22% of more than 250 Zacks industries.

Given this encouraging backdrop, it would be a wise decision to invest in some dividend-paying companies like Ryder System, Inc. R and The Greenbrier Companies, Inc. GBX from the Transportation - Equipment and Leasing industry. These companies have consistently announced dividend hikes, thus highlighting their pro-shareholder stance.

Stocks that have a strong history of dividend growth belong to mature companies, which are less susceptible to large swings in the market and act as a hedge against economic or political uncertainty as well as stock market volatility. At the same time, they offer downside protection with their consistent increase in payouts.

Additionally, these companies have superior fundamentals like a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics.

How to Pick Stocks With Solid Dividend Payouts?

In order to choose some of the best dividend stocks from the industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%.

Greenbrier: Headquartered in Lake Oswego, OR, Greenbrier designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

Greenbrier pays out a quarterly dividend of 30 cents ($1.20 annualized) per share, which gives it a 2.40% yield at the current stock price. This company’s payout ratio is 31%, with a five-year dividend growth rate of 2.66%. (Check Greenbrier’s dividend history here).

Greenbrier Companies, Inc. (The) Dividend Yield (TTM)

Greenbrier Companies, Inc. (The) dividend-yield-ttm | Greenbrier Companies, Inc. (The) Quote

Greenbrier presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Greenbrier’s consistent efforts to reward its shareholders through dividends and share repurchases look encouraging. In 2022, Greenbrier paid dividends of $35.8 million (but did not repurchase any shares). In 2023, the company paid dividends of $36.1 million and repurchased shares worth $56.9 million. During the first half of 2024, Greenbrier rewarded its shareholders through dividends of $19.7 million and repurchased shares worth $1.3 million. Such shareholder-friendly moves instill investor confidence and positively impact the company's bottom line.

Ryder: Headquartered in Coral Gables, FL, Ryder operates as a logistics and transportation company worldwide. Currently, R has a market capitalization of $5.25 billion.

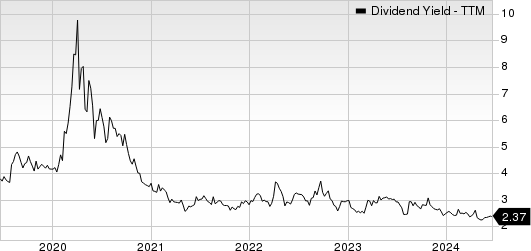

Ryder pays out a quarterly dividend of 71 cents ($2.84 annualized) per share, which gives it a 2.37% yield at the current stock price. This company’s payout ratio is 23%, with a five-year dividend growth rate of 5.29%. (Check Ryder’s dividend history here). Ryder presently carries a Zacks Rank #3 (Hold).

Ryder System, Inc. Dividend Yield (TTM)

Ryder System, Inc. dividend-yield-ttm | Ryder System, Inc. Quote

We are impressed with Ryder’s consistent efforts to reward its shareholders through dividends and share repurchases. In 2022, Ryder paid dividends of $123 million and repurchased shares worth $557 million. In 2023, the company paid dividends of $128 million and repurchased shares worth $337 million. During first-quarter 2024, Ryder paid dividends of $35 million and repurchased shares worth $51 million. Such shareholder-friendly moves instill investor confidence and positively impact the company's bottom line.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Greenbrier Companies, Inc. (The) (GBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance