2 Brilliant High-Yield Dividend Stocks to Buy Now

Some of the most attractive dividend-paying stocks available are real estate investment trusts, or REITs. When you buy shares of a REIT, you're essentially buying into physical assets with long life spans. That strategy offers a safety net for investors, because they own part of the underlying asset in addition to the income those assets provide. Two I particularly like are Iron Mountain (NYSE: IRM) and Welltower Inc. (NYSE: HCN). They offer investors an effective way to invest in the information storage/security and healthcare industries -- and both have dividend yields topping 5%.

Mountain of a dividend

Iron Mountain is the global leader for storage and information management solutions, and boasts an impressive footprint with more than 87 million square feet of space in 1,433 facilities across 53 countries. Its stores everything from medical images to hard-copy records to film, boasts a 99.99% inventory accuracy rate, and serves 95% of the Fortune 1000. The company offers a number of attractive real estate characteristics such as low turnover costs, low maintenance capital expenditure and high customer retention. A great example is that 50% of boxes stored 15 years ago still remain within its facilities, and 25% of boxes stored 22 years ago are still present.

Image source: Getty Images.

Management also recognizes the opportunities ahead, such as transforming its business to include storing digital information. One of the company's solutions is named Iron Cloud -- its entry into the cloud storage, disaster recovery and data archiving solutions markets, which are expected to grow by 25% to 30% from 2016 through 2021. And despite a general decline in paper-based records, many of the industries Iron Mountain serves -- including finance, healthcare and law -- are highly regulated, and will keep needing to maintain physical copies of documents, giving its business model extra resiliency.

The company also has room for growth through acquisitions, such as its 2016 acquisition of Recall Holdings, as well as the outsourcing trend that's growing in many emerging markets, where companies are looking for secure ways to preserve their data. Iron Mountain is even aiming to generate 5% of total revenue by 2020 through adjacent businesses, such as art storage. Even if you don't see Iron Mountain as an investor's dream, as some do, it's a stable yet growing business and with a dividend yield of 5.82%.

An aging angle

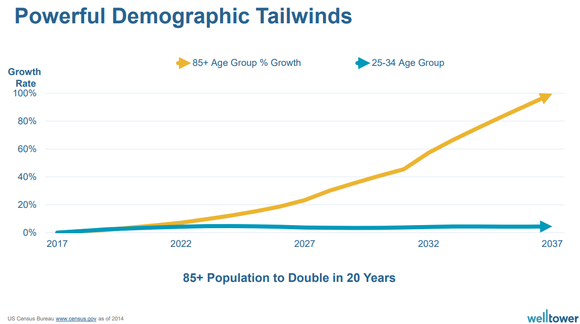

Welltower owns a multitude of senior housing facilities, nursing/post-acute facilities and medical office buildings across the U.S., Canada and the U.K. Its goal: to deliver healthcare infrastructure that will facilitate better treatment at lower costs. Its properties house roughly 198,000 residents, and its professional tenants handle 16 million outpatient medical visits a year. But what investors should focus on today are the powerful demographic trends that could push its business higher in the decades ahead.

Graphic source: Welltower November 7, 2017 third-quarter presentation.

When looking at the graph above, keep in mind that members of the 85 and older demographic spend, on average, a staggering 390% more on healthcare annually than the average American. Not only does an aging population provide Welltower with growth opportunities, the company already owns high-quality properties in attractive, high-barrier-of-entry locations, such as larger cities. And a survey Welltower commissioned this year reaffirmed that aging city dwellers desire to age in place, and showed that 81% were open to living in an urban senior living community.

Investors also should keep in mind that much of Welltower's senior housing portfolio is comprised of operating partnerships, rather than leased properties. That means Welltower and its investors benefit directly from increases in the income generated by those properties. As it continues to build its portfolio of real estate in high-barrier locations and expand internationally, it's positioned to keep rewarding shareholders, just as it has done for a long time.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends Welltower. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance