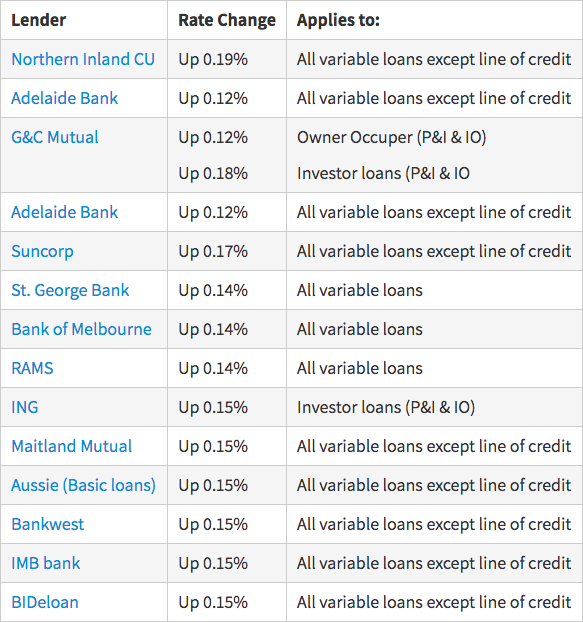

Heads up: These 13 smaller lenders have also increased home loan rates

Aussie borrowers turning to smaller lenders to escape rate hikes are meeting a diminishing set of options as even smaller lenders begin to move.

The supposed safe haven from rate hikes offered by smaller banks is disappearing, with 13 lenders increasing their rates since August 29.

Also read: These are the best countries to live and work in

That was the day Westpac announced rate hikes, citing overseas funding pressures, with smaller lenders also feeling the pinch, comparison service, Mozo said.

“Smaller lenders are subject to the same funding cost pressures the big four has attributed to their rate hikes,” said Mozo data manager, Peter Marshall.

“It’s for this reason many of them have lifted their home loan rates.”

What does that mean for me?

A 0.15 per cent increase doesn’t sound like much but can make a major difference. Mozo gave the example of someone borrowing $300,000 over 30 years. If they had the average home loan rate of 4.37 per cent, their average monthly repayments would be $1,497.

Also read: How you could have turned $10,000 into $440,000 in 10 years

However, a 0.15 per cent increase would see their interest rate grow to 4.52 per cent and monthly repayments to $1,524. That’s an extra $27 a month, or $324 a year.

““A 15 basis point price jump may not seem like much on paper, but could equate to thousands over the many years it takes to pay off a loan,” Marshall said.

“No benefit comes from paying more interest than you have to, and if you’re not on a low rate, you should be.”

The good news

However, Aussie borrowers can breathe a small sigh of relief; rates are unlikely to go up again for a long time.

“After another month of the official cash rate remaining steady, and funding costs remaining relatively stable, I expect most lenders would not have any further plans to increase variable rates in the near future,” Marshall explained.

Nevertheless, borrowers should still consider changing banks, with some banks offering rates as low as 3.44 per cent.

Yahoo Finance

Yahoo Finance