The 10 Biggest Railroad Stocks

The railroad sector offers retail investors the relative security of being in a historically important industry that is vital to the U.S. economy. The great benefit of investing in the railroad sector is that the railroads themselves have a lot of market security. After all, Berkshire Hathaway's BNSF and Union Pacific are effectively a duopoly in the West, and CSX and Norfolk Southern are similar in the East, while Canadian Pacific and Canadian National dominate Canada, and the far smaller Kansas City Southern runs routes through the South and Mexico.

Together, these seven railroads generate more than $90 billion in annual revenue. They are categorized as Class I railroads by the Surface Transportation Board (STB), and they account for the majority of freight rail activity in the U.S. The good news is that you can invest in each and every one of them.

What are Class I railroads?

In case you are wondering, Class I railroads are defined by the STB as those with annual revenue greater than $447.6 million. They are regulated by the STB and are obliged to file "annual and periodic financial and statistical reports," according to the organization. For reference, Class II railroads are classified as those with annual revenue of between $35.8 million and $447.6 million, but unfortunately, there is no direct way to invest in them. It's a similar situation with Class III railroads, which are classified as generating less than $35.8 million in annual revenue.

U.S. readers might be unfamiliar with the Canadian National Railway and Canadian Pacific, but they may know their respective operating companies in the U.S.: the Grand Trunk Western Railroad Company and the Soo Line Railroad.

Image source: Getty Images.

The railroad business

This is the easy bit. In a nutshell, railroads carry freight across their networks and charge companies for doing so, sometimes on a long-term contractual basis. That's the basic business of the railroads, and it's fair to say that their revenues, by and large, follow the cyclicality of the economy.

That said, it would be a mistake to think about railroads as a boring, sleepy industry with GDP-type growth prospects. Railroads obviously do have cyclical exposure to the economy, but as you will see shortly, they all have their own individual end-market exposures and specific earnings drivers. Moreover, rail freight both competes and cooperates with trucking and shipping for cargo transportation.

The latter comes through something called intermodal transportation (all the railroads break this out as a line item in their results). Simply put, intermodal transportation involves moving a standard container from, say, ship to truck and vice versa -- or in this case truck to rail and ship to rail.

Structural changes in the railroad industry

Before getting into the details of each individual company, it's worth noting two key trends that could have a significant impact on all of them.

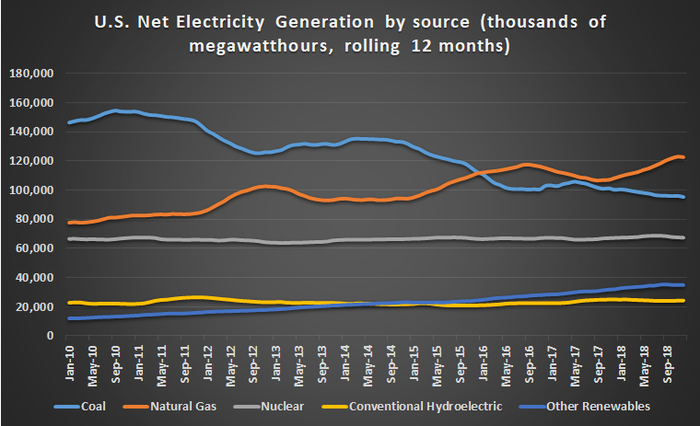

The first is the declining usage of coal as a source of electricity generation in the U.S., which is negatively impacting coal rail traffic -- traditionally a significant source of revenue for railroads. For example, the amount of coal used for electricity generation (measured in megawatt hours) declined nearly 35% between 2010 and 2018, and U.S. coal rail traffic fell around 39% over the same period. Consequently, BNSF's coal revenue declined by around 8% in the 2010-2018 period, with coal representing less than 18% of revenue in 2018 compared to nearly 27% in 2010.

Data source: U.S. Energy Information Association.

To illustrate the impact of the declining use of coal, here's a look at the fall in its share of railroad revenue over the decade in question. The chart provides a useful primer and reference point for which railroads have more exposure to a commodity seemingly facing a structural decline in demand.

Data source: Company presentations.

Precision scheduled railroading

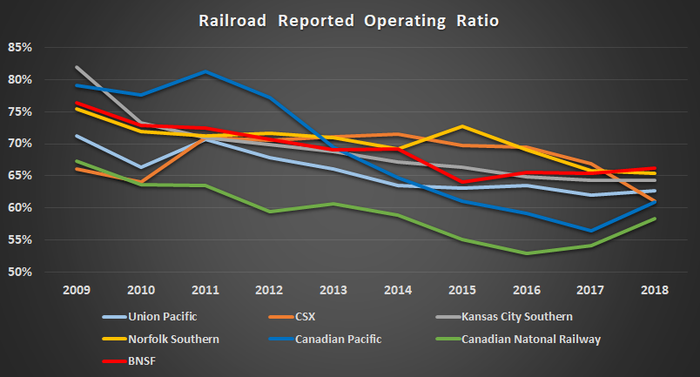

The second structural change is the remarkable reduction in railroad operating ratios (a commonly used measure of expenses over revenue, where a lower number is better) achieved by the application of precision scheduled railroading (PSR).

It's a system that emphasizes consistently running trains between two points on a network at a specified time. This is differentiated from the traditional hub-and-spoke model, where railcars tend to enter a hub and are then attached to a train en route to its final destination.

The evidence strongly suggests that PSR, developed and implemented by legendary railway CEO Hunter Harrison, works. BNSF is the only Class I railroad not implementing it as of 2019. As you can see below, Harrison's time as CEO of the Canadian railroads was highly successful in terms of reducing operating ratios, and his PSR principles were highly effective at CSX, too.

Data source: Company presentations. Figures represent operating ratio in the year before his tenure as CEO compared to last year of tenure. *Harrison died in late 2017; his PSR plans were continued into 2018.

In order to further demonstrate the potential for PSR to lead to an operational improvement in the industry, and to provide a useful point for further discussion, here's a chart of Class I railroad operating ratios in the 2009-2018 period. There will be more to say about this chart later, but for now, note how the Canadian railroads gradually improved under PSR, and note how well CSX did after beginning adoption in 2017.

Data source: Company presentations.

List of biggest railroad-sector stocks

With this as a backdrop, let's start looking at the 10 largest companies by focusing on the six listed railroads and Warren Buffett's Berkshire Hathaway. I've also included two rail locomotive manufacturers, Caterpillar and Wabtec, in the mix, and a railcar manufacturing and leasing company, Trinity Industries. More on them later.

Company | Activity |

|---|---|

Berkshire Hathaway (NYSE: BRK-B) | A diversified conglomerate; owner of BNSF, a railroad focused on the western two-thirds of the U.S. |

Caterpillar (NYSE: CAT) | Makes rail locomotives; part of much larger construction, mining and oil, and gas machinery company |

Union Pacific (NYSE: UNP) | Railroad covering western two-thirds of U.S. |

CSX (NASDAQ: CSX) | Eastern U.S. railroad |

Norfolk Southern (NYSE: NSC) | Eastern U.S. railroad |

Canadian National Railway (NYSE: CNI) | Canadian and U.S. railroad through Chicago to New Orleans and Iowa |

Wabtec (NYSE: WAB) | Makes locomotives, freight car products, brakes, and signaling and train control equipment |

Canadian Pacific Railway (NYSE: CP) | Canadian and U.S. railroad |

Kansas City Southern (NYSE: KSU) | Southern U.S. and Mexico railroad |

Trinity Industries (NYSE: TRN) | Railcar manufacturer and leasing company |

Data source: Company presentations. Trailing 12-month revenue.

Berkshire Hathaway/BNSF

BNSF is actually the largest railroad in North America by revenue ($23.9 billion in 2018), with only its chief competitor in the west, Union Pacific, rivaling it in terms of revenue. The other western railroad, Kansas City Southern, is around 9 times smaller than its two neighbors. However, it's part of a much larger company and is only responsible for around 10% of Berkshire Hathaway.

You aren't going to buy Berkshire Hathaway stock just because of BNSF, but a viewpoint on it will be part of the overall decision. Moreover, BNSF is important because it's the largest railroad, and because it's the only Class I railroad that hasn't implemented PSR yet -- note the relatively high operating ratio in 2018.

Buffett and BNSF's management are believed to be open to the idea. But its implementation at the railroad could have far-reaching consequences for railroad equipment companies like Caterpillar, Trinity Industries, and Wabtec, because the greater efficiency of PSR is seen as potentially threatening demand for locomotives, railcar manufacturers, and freight car technology suppliers.

Union Pacific

As you can see in the chart above, Union Pacific's operating ratio did drop in the decade after the recession, but the drop didn't match that of the second-largest listed railroad, CSX. Consequently, management decided to follow CSX in adopting a PSR-based operating plan in late 2018. If it works, investors can look forward to a higher profit margin in the future.

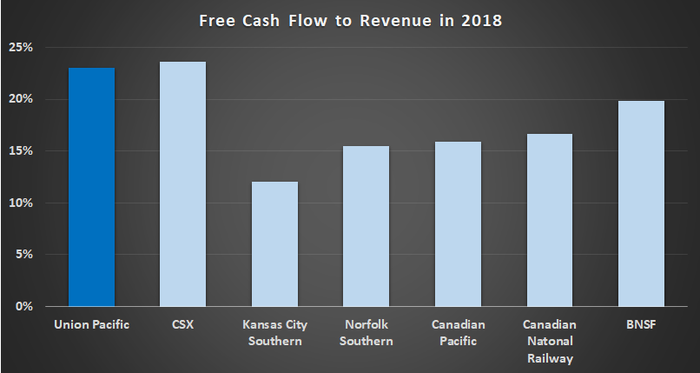

That's good news, and it comes from a railroad with a reputation for being one of the best cash generators in the industry. Why? For one thing, scale matters in this industry. The largest listed railroads -- namely Union Pacific, CSX, and Norfolk Southern -- tend to have the lowest capital expenditure-to-revenue ratios, so more of the cash flow they generate from their operations tends to end up as free cash flow.

Data source: Company presentations.

In addition, investors worried about Union Pacific's relatively high exposure to coal should note that its exposure largely comes out of the Powder River Basin -- traditionally the lowest-cost producer of coal in the U.S. In other words, it's likely to do better in the long term than Eastern railroads with exposure to the more expensive coal-producing areas such as the Appalachians.

CSX

As we noted in our article about how to invest in railroad stocks, CSX is a company in a hurry. As the last of the Class I railroads run by the late Hunter Harrison, the company's adoption of PSR is key to its investment thesis. The initial impact on its operating ratio has already been outlined in this article -- see charts above -- and management has already generated significant productivity improvements, shown in metrics such as train velocity and terminal car dwell.

As an indication of CSX's long-term plans, and also a red flag as to how the adoption of PSR reduces demand for railcars and locomotives, it should be noted that management planned to reduce the number of freight cars it has online by 28% and its active locomotives by 20%.

CSX's primary competitor is Norfolk Southern. As you can see above, its operating ratio tends to be lower than its rival's, and it also tends to be a better cash generator -- something that will improve dramatically as PSR cuts capital expenditure requirements.

Image source: Getty Images.

Exposure to coal (see chart above) is a significant concern, particularly as management states that "roughly one-third of export coal and the majority of the domestic coal that the Company transports is used for generating electricity." In other words, if gas and renewables continue to replace coal as a source of energy, then CSX's coal revenue will continue to come under pressure. This is a particular concern given the railroad's exposure to more costly Appalachian coal.

The Canadian railroads

Not only based in the same country but also sharing a CEO in common (Hunter Harrison), the two Canadian railroads also have major operations in the U.S. Operating under the name of Grand Trunk in the U.S., Canadian National is roughly double the size of its compatriot Canadian Pacific (known as Soo Line Railroad Company) in the U.S.

Given their relative underexposure to coal, the two will be attractive for investors looking to avoid coal, but the fact that both railroads have utilized PSR for some time means that improving their operating ratios will be relatively harder in the future.

Norfolk Southern

One of the most interesting investment options is Norfolk Southern. Its main competitor is CSX, and the potential for Norfolk Southern to play catch-up with CSX looks significant.

The chart below shows how CSX pulled away from Norfolk Southern in terms of operating income and free cash flow margin in the 2017-2018 period as the former adopted PSR. It didn't take long for Norfolk Southern to respond, and its management started implementing PSR in 2019.

Data source: Company presentations.

In a sign of how PSR reduces capacity, Norfolk Southern adopted a three-year plan to cut its number of employees from around 26,662 to 23,600. Similarly, the plan involved decreasing its locomotives from 4,197 to around 3,700 -- numbers that investors in railcar equipment companies like Wabtec, Caterpillar, and Trinity Industries should pay close attention to.

Kansas City Southern

Among railroads, this is the odd man out. Not only is Kansas City Southern by far the smallest of the Class I railroads -- its revenue is almost 9 times less than BNSF's -- but it's also a standout among U.S. railroads because of its relatively small exposure to coal. In common with Union Pacific, Kansas City Southern transports coal originating in the Powder River Basin.

In addition, the railroad operates extensively in Mexico. The railroad's Kansas City Southern de Mexico "has the right to operate approximately 3,300 route miles, but does not own the land, roadway, or associated structures, and additionally has approximately 550 miles of trackage rights," according to company reports.

As such, there isn't a case for buying Kansas City Southern stock if you don't believe in the future of U.S./Mexico trade. It's something that provides both strength and weakness to the company.

Last but not least, the railroad has upside potential thanks to its decision to join every other publicly listed Class I railroad and implement PSR methodology in 2019. So investors can expect a multiyear effort to lower its operating ratio, which, as you can see in the chart above, starts at a relatively high level.

Caterpillar

In common with Berkshire Hathaway on this list, no one is going to buy Caterpillar's stock specifically for its transportation exposure, but that's not to say it's insignificant. After all, the company's locomotives tend to contribute up to 30% of the energy and transportation segment revenue. And given the cyclicality of the company's construction and mining machinery equipment end markets, energy and transportation can end up contributing the bulk of earnings.

For example, in 2016, the energy and transportation segment contributed $2.2 billion in earnings compared to around $2.8 billion in total for Caterpillar's equipment machinery earnings before corporate items. While Caterpillar is far from a pure play on railroad investment, this is a key factor in deciding to buy the stock.

Moreover, following trends in Caterpillar's locomotive sales is a very useful exercise for shareholders in its rival Wabtec.

Wabtec and Trinity Industries

In comparison to Caterpillar, Wabtec and Trinity Industries are both stocks to play in the area of railroad infrastructural spending. Wabtec has been an aggressive consolidator in the industry over the years, and management has increased its exposure to the market through acquisitions. It acquired a majority stake in Faiveley Transport, a France-based train equipment company, in 2016 and grew those holdings to nearly 100% of the company in 2017.

A year later, Wabtec's management announced its most ambitious deal yet: an agreement to merge with GE Transportation, Caterpillar's key competitor in the locomotive market. Adding GE's locomotives to Wabtec's existing freight car products, brakes, train control, and signaling equipment is obviously complementary. But shareholders in Wabtec and railcar manufacturer Trinity Industries must answer one key question: What happens to railroad capital spending with the ongoing move to PSR implementation?

Image source: Getty Images.

In common with Wabtec, Trinity decided to double down on the railroad industry when it spun off its infrastructure-related business, now listed as Arcosa, in late 2018, leaving Trinity as a pure-play railroad company. Its key customers include railroads like BNSF, Union Pacific, and Canadian National.

History and the plans of railroads suggest that PSR improves productivity and reduces a railroad's capacity requirements, and that means less demand for locomotives and railcars. That's a difficult scenario for railroad equipment suppliers.

Investing in the railroad industry

Having already read about how to invest in railroad stocks and investigated the investing options in terms of the largest railroad companies on the market, readers should have a good background in the underlying themes in investing in the sector.

The sector will attract investors who don't want to play the guessing game of which company will win out in an industry -- after all, the Class I railroads are essentially duopolies within their individual geographies. However, they do have a mix of end-market and geographic exposures and are all at different stages of adopting PSR.

Alternatively, you could avoid trying to pick a winner and just buy a bunch of railroad stocks. After all, in the 2000-2018 period, the average return of the six listed railroad stocks was around 1,300%, compared to the S&P 500 return of 70% in the same period. That's not bad for what's supposed to be a sleepy, boring industry. There's a lot more to investing in the railroad sector than meets the eye.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares), Canadian National Railway, and Westinghouse Air Brake Technologies. The Motley Fool has the following options: short January 2021 $200 puts on Berkshire Hathaway (B shares) and long January 2021 $200 calls on Berkshire Hathaway (B shares). The Motley Fool recommends Union Pacific. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance