Zimmer Biomet (ZBH) Q1 Earnings Beat, Margins Expand

Zimmer Biomet Holdings, Inc. ZBH posted first-quarter 2024 adjusted earnings per share (EPS) of $1.94, exceeding the Zacks Consensus Estimate by 3.7%. The adjusted figure increased 2.6% year over year.

The quarter’s adjustments included certain amortization, restructuring and other cost reduction initiatives and European Union Medical Device Regulation-related charges, among others.

On a reported basis, the company registered earnings of 84 cents per share, which reflected a 24.3% decline from the year-ago figure.

Revenue Details

First-quarter net sales of $1.89 billion increased 3.2% (up 4.4% at constant exchange rate or CER) year over year. The figure beat the Zacks Consensus Estimate by 1%.

Geographic Details

During the first quarter, sales generated in the United States totaled $1.09 billion (up 3.7% year over year), while International sales grossed $790 million (up 5.4% year over year at CER).

Our model projected 1% revenue growth for the United States and 5.8% growth at CER for the International arm in the first quarter.

Segments

The company currently reports through four product categories — Knees, Hips, S.E.T. (Sports Medicine, Extremities, Trauma, Craniomaxillofacial and Thoracic) and Other.

Sales in the Knees unit improved 4.3% year over year at CER to $788.1 million. Our model estimate was pegged at $762.3 million.

Hips recorded 1.5% growth in the first quarter at CER to reach $491.2 million. Our model estimate was $505.4 million for the same.

Revenues in the S.E.T. unit were up 5.3% year over year at CER to $452.6 million. Our model estimate was $437.6 million.

Other revenues increased 12.2% to $157.3 million at CER in the first quarter. Our model estimate was $165.5 million.

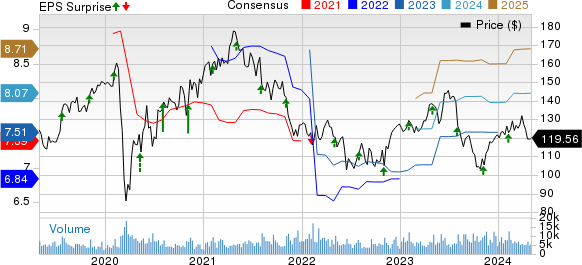

Zimmer Biomet Holdings, Inc. Price, Consensus and EPS Surprise

Zimmer Biomet Holdings, Inc. price-consensus-eps-surprise-chart | Zimmer Biomet Holdings, Inc. Quote

Margins

Adjusted gross margin, after excluding the impact of intangible asset amortization, was 72.9%, reflecting an expansion of 23 basis points (bps) in the first quarter. Selling, general and administrative expenses rose 2.8% to $736.2 million. Research and development expenses declined 2.3% to $107.9 million. Adjusted operating margin expanded 68 bps to 28.2% in the quarter.

Cash Position

Zimmer Biomet exited the first quarter with cash and cash equivalents of $393 million compared with $415.8 million at the end of 2023.

Cumulative net cash provided by operating activities at the end of the first quarter was $228 million compared with $307.7 million in the year-ago period.

2024 Guidance

Zimmer Biomet reiterated its financial guidance for 2024.

Reported revenue growth is expected to be in the band of 4.5%-5.5% year over year. The company currently expects foreign exchange to have an adverse impact of 0.5% on revenues.

Adjusted EPS for the full year is expected in the range of $8.00-$8.15.

The Zacks Consensus Estimate for 2024 adjusted earnings per share is pegged at $8.08 on revenues of $7.75 billion.

Our Take

Zimmer Biomet ended the first quarter of 2024 on a bright note, with an earnings and revenue beat. Each of the company’s geographic segments recorded strong year-over-year sales growth on a reported basis, as well as at CER. The company’s business segments, too, reported strong growth on a CER basis. Management noted solid execution of growth strategies in the reported quarter. Even amid the challenging macroeconomic conditions, the company’s adjusted gross and operating margins improved.

In the first quarter, the company progressed in terms of innovation and received FDA clearances for its ROSA Shoulder System as well as the Z1 Femoral Hip Stem.

Zacks Rank and Key Picks

Zimmer Biomet currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, ResMed Inc. RMD and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported adjusted EPS of $2.14 for first-quarter 2024, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

ResMed reported adjusted EPS of $2.13 for third-quarter fiscal 2024, beating the Zacks Consensus Estimate by 10.9%. Revenues of $1.19 billion surpassed the Zacks Consensus Estimate by 1.9%. It currently carries a Zacks Rank #2.

ResMed has a long-term estimated growth rate of 10.9%. RMD’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Boston Scientific reported adjusted EPS of 56 cents for first-quarter 2024, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance