Where property prices have crashed since Covid-19

Inner city Melbourne and Sydney homeowners are reeling, with suburbs in these areas posting the largest declines in property prices over the last two months.

While property values have declined just 0.4 per cent overall across the month of May, according to data from CoreLogic, the performance of individual states paint a different picture.

Perhaps unsurprisingly, the most expensive parts of Sydney and Melbourne seem to be leading the current downswing.

“Over the month of May, dwelling values in the top quartile of the Melbourne market had fallen by 1.3 per cent, compared with a 0.6 per cent decline across the middle of the market and a 0.3 per cent decline in the lowest value quartile,” CoreLogic stated.

Across Sydney, the highest market segment also saw the biggest decline: 0.6 per cent, compared to a 0.4 per cent decline across the middle of the market and a 0.1 per cent increase in the lowest value segment.

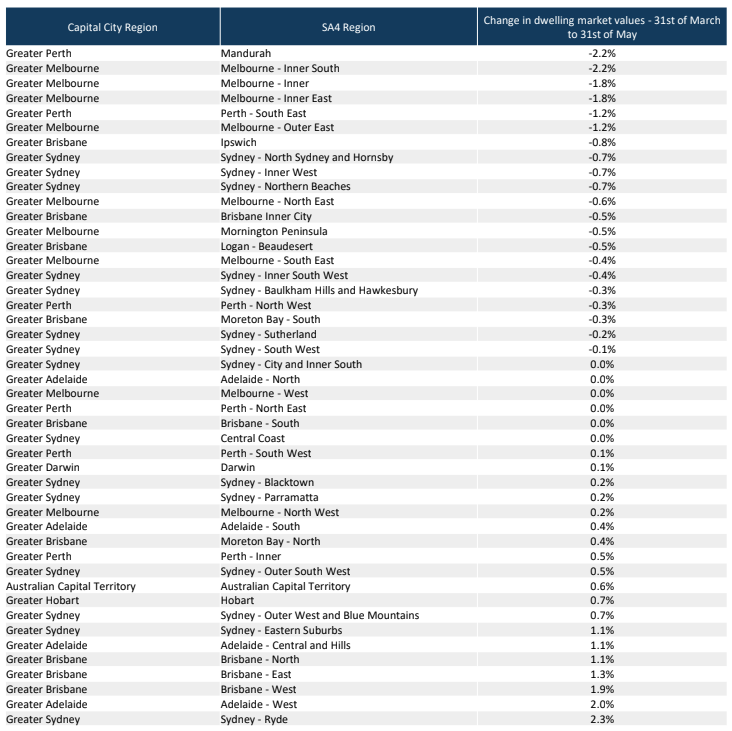

Which areas have been hit the hardest?

The Perth district of Mandurah has fared the worst, posting the largest decline in dwelling market value over the past two months. In fact, its May dwelling values were a whopping 38 per cent below their 2006 peak.

“International border closures in response to COVID-19 may have created a significant demand shock which had interrupted a recovery in the Perth south-east region,” CoreLogic stated.

“Prior to this, dwelling values in the area had seen four consecutive months of growth between December 2019 and March 2020.”

Malvern East in Melbourne has been the worst suburb-level performer between the end of March and the end of May across the capital cities, with total dwelling values down 4.8 per cent.

The Melbourne suburbs of Glen Iris, Northcote, Port Melbourne and Brunswick East also suffered relatively steep value falls.

In Sydney, the biggest suburb-level falls in dwelling values occurred in Mosman (-2.5 per cent), Lane Cove North (-2.4 per cent), Manly (-2.3 per cent), Leichhardt (-1.7 per cent) and Wentworth Point (-1.4 per cent).

This table reveals the change in dwelling values since coronavirus:

CoreLogic expects continued declines in inner-city markets that had previously relied on international migration for new housing demand, but notes declines will become more broad-based.

“As the wider economic downturn drags on housing demand, mild price declines are likely to spread, resulting in a more broad-bases downturn in the next 12 months.”

Which areas will bounce back?

Areas that aren’t so reliant on international students and tourism, and that have little or no coronavirus cases will show some price growth over the next six months, Domain economist Trent Wiltshire told Yahoo Finance.

“Prices may grow modestly - or at least outperform other cities - in Perth, Adelaide and Canberra,” Wiltshire said.

“A key reason it the fact there are few Covid-19 cases, or even none, and the economy can reopen and pretty quickly return to some form of normality.”

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!

Yahoo Finance

Yahoo Finance