NetApp's (NTAP) New AFF A-Series Systems to Address IT Workload

NetApp NTAP launched its latest AFF A-Series systems, which are designed to tackle demanding IT workloads like GenAI, VMware, and enterprise databases. The company has also enhanced its portfolio to assist customers in operating more efficiently with their data.

The artificial intelligence (AI)-driven landscape has pushed organizations to innovate swiftly, enhance customer experiences, combat cyber threats and boost productivity. The new product aims to offer intelligent data infrastructure to unlock the potential of AI-driven insights. The new AFF A-Series systems extend the company’s footprint in unified data storage for the next generation of workloads.

The new AFF A-Series is built on technology that is used by major public clouds. These systems eliminate storage silos and complexity as well as provide intelligent and secure storage solutions to accelerate and optimize various workloads. They include integrated features to optimize VMware storage costs and ensure future flexibility.

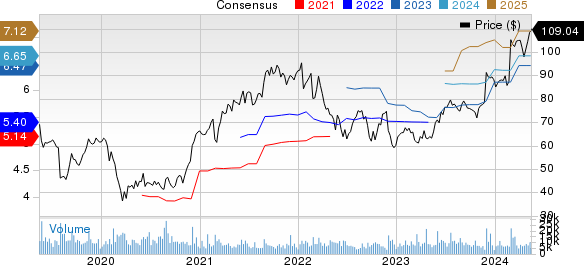

NetApp, Inc. Price and Consensus

NetApp, Inc. price-consensus-chart | NetApp, Inc. Quote

Additionally, the company also introduced advanced capabilities to meet the demands of modern workloads like GenAI. Per a report from Fortune Business Insights, the generative AI market size was valued at $29 billion in 2022 and is projected to witness a CAGR of 47.5% from 2023 to 2030. The industry is likely to benefit from increasing adoption of VR, AR and machine learning, added the report.

The new capabilities include the StorageGRID model, which improves the value of unstructured data while reducing the total cost of ownership and power consumption. It also includes a cyber vault reference architecture, which protects customer data against advanced cyber threats.

Apart from this, the company has also added SnapMirror Active Sync, FlexCache with Writeback, collaboration with Lenovo for AI infrastructure, and BlueXP Classification for enhanced data intelligence.

NetApp provides enterprise storage as well as data management software and hardware products and services. The company expects cloud storage consumption to benefit from the secular trends in AI, machine learning, IoT and high-performance computing coupled with the migration of enterprise apps like VMware & SAP. The company’s advanced portfolio of ransomware protection solutions is likely to gain momentum amid rising cybersecurity risks.

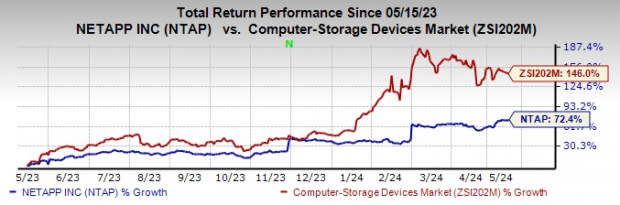

At present, NetApp carries a Zacks Rank #2 (Buy). The stock has gained 72.4% compared with the sub-industry’s growth of 146% in the past year.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Woodward WWD, Arista Networks ANET and Super Micro Computer SMCI. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Woodward’s fiscal 2024 earnings per share (EPS) has moved up 9.3% in the past 60 days to $5.76. WWD’s long-term earnings growth rate is 16.3%.

Woodward’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 26.1%. WWD shares have risen 62% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.9% in the past 60 days to $7.53. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 127.3% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2024 EPS has improved 8.3% in the past 60 days to $23.51. SMCI’s long-term earnings growth rate is 52.3%.

SMCI’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 6.9%. Shares of SMCI have risen 481% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance