National Australia Bank Ltd's Dividend Analysis

Exploring the Sustainability and Performance of Dividends

National Australia Bank Ltd (NABZY) recently announced a dividend of $0.27 per share, payable on 2024-07-10, with the ex-dividend date set for 2024-05-10. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into National Australia Bank Ltd's dividend performance and assess its sustainability.

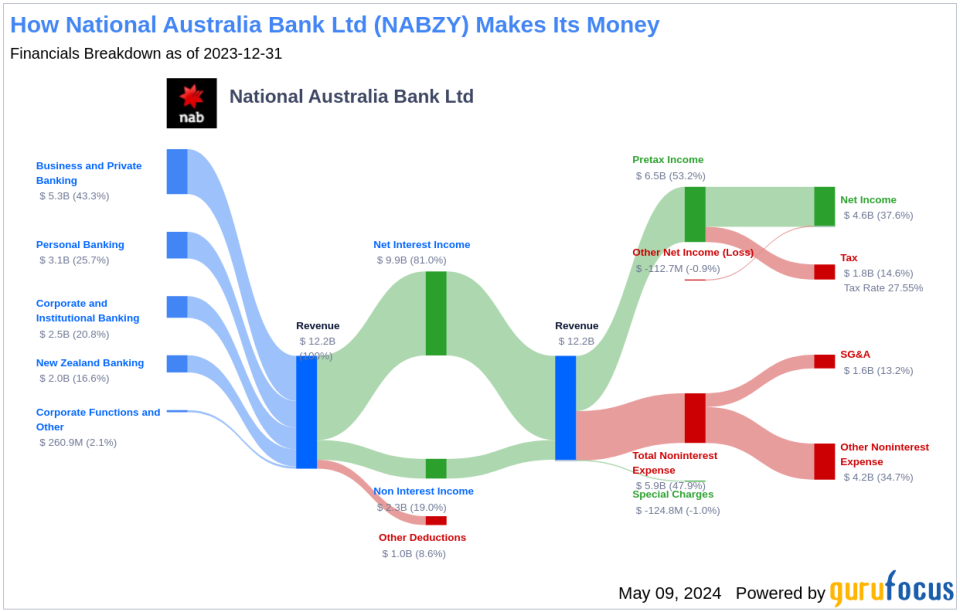

What Does National Australia Bank Ltd Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

National Australia Bank is the most business-focused of the four major banks, holding the largest share of business loans and the number-three spot in home loans. National Australia Bank is currently the second-largest bank by market capitalization, with the franchise covering consumer, small business, corporate, and institutional sectors. Under the UBank brand the bank also owns one of Australia's largest digital-only banks. Offshore operations in New Zealand round out the group.

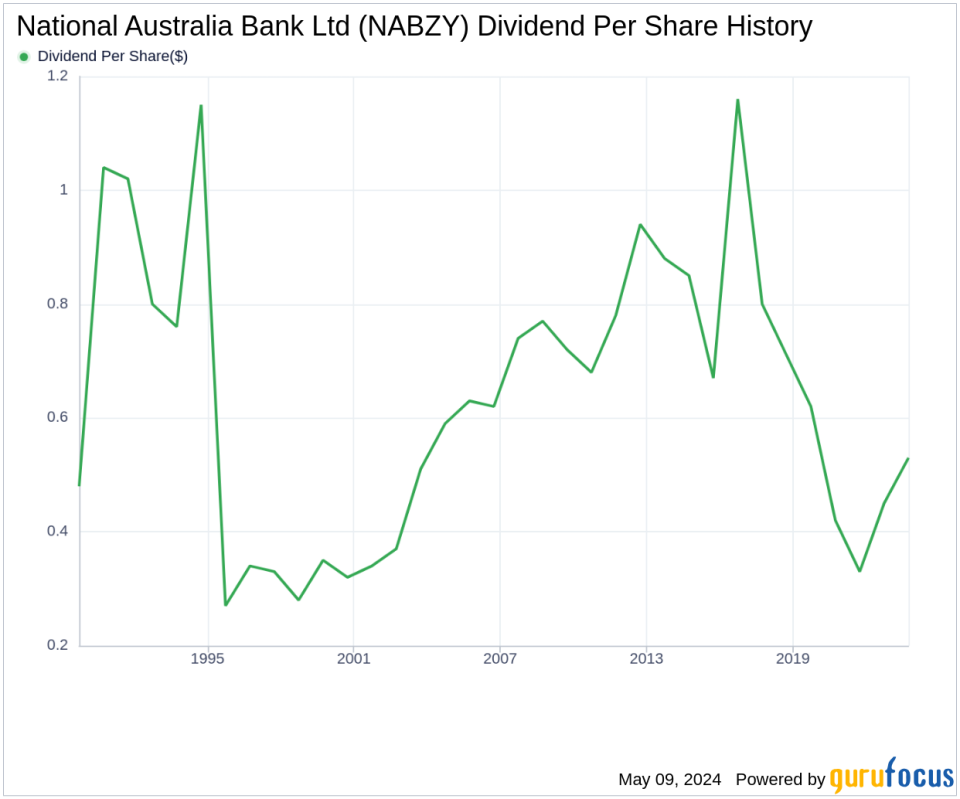

A Glimpse at National Australia Bank Ltd's Dividend History

National Australia Bank Ltd has maintained a consistent dividend payment record since 1989. Dividends are currently distributed on a bi-annual basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

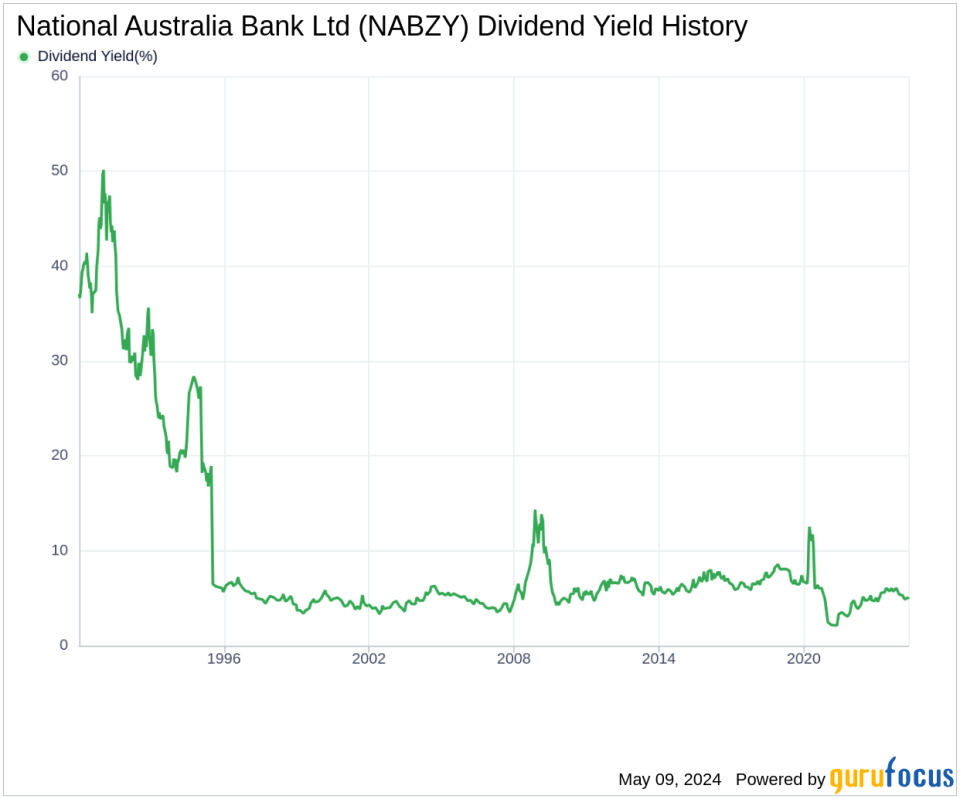

Breaking Down National Australia Bank Ltd's Dividend Yield and Growth

As of today, National Australia Bank Ltd currently has a 12-month trailing dividend yield of 4.93% and a 12-month forward dividend yield of 4.88%. This suggests an expectation of decreased dividend payments over the next 12 months.

Over the past three years, National Australia Bank Ltd's annual dividend growth rate was 12.50%. Extended to a five-year horizon, this rate decreased to -5.70% per year. And over the past decade, National Australia Bank Ltd's annual dividends per share growth rate stands at -4.80%.

Based on National Australia Bank Ltd's dividend yield and five-year growth rate, the 5-year yield on cost of National Australia Bank Ltd stock as of today is approximately 3.68%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2024-03-31, National Australia Bank Ltd's dividend payout ratio is 0.77, which may suggest that the company's dividend may not be sustainable.

National Australia Bank Ltd's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks National Australia Bank Ltd's profitability 4 out of 10 as of 2024-03-31, suggesting the dividend may not be sustainable. The company has reported positive net income for each of year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. National Australia Bank Ltd's growth rank of 4 out of 10 suggests that the company has poor growth prospects and thus, the dividend may not be sustainable.

Revenue is the lifeblood of any company, and National Australia Bank Ltd's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. National Australia Bank Ltd's revenue has increased by approximately 5.70% per year on average, a rate that underperforms than approximately 55.78% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, National Australia Bank Ltd's earnings increased by approximately 25.80% per year on average, a rate that underperforms than approximately 29.58% of global competitors.

Lastly, the company's 5-year EBITDA growth rate of 0.80%, which underperforms than approximately 76.42% of global competitors.

Next Steps

Given National Australia Bank Ltd's dividend payments, dividend growth rate, payout ratio, profitability, and growth metrics, investors should monitor these factors closely to gauge future dividend sustainability. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance