IPhone Maker Hon Hai Misses Estimates in a China Downturn

(Bloomberg) -- Hon Hai Precision Industry Co. reported a weaker-than-expected profit as demand for iPhones remained sluggish in China, though it projected significant growth in the current quarter.

Most Read from Bloomberg

US Inflation Data Was Accidentally Released 30 Minutes Early

Putin and Xi Vow to Step Up Fight to Counter US ‘Containment’

With a BlackRock CEO, $9 Trillion Vanguard Braces for Turbulence

Jamie Dimon Sees ‘Lot of Inflationary Forces in Front of Us’

Dow Average Touches 40,000 Before Pulling Back: Markets Wrap

The Taiwanese company, a key partner to both Apple Inc. and Nvidia Corp., gave that forecast after reporting its strongest monthly sales since the start of 2023, buoyed by rising demand for servers during the AI boom. It reported net profit of NT$22 billion ($679 million) in the March quarter. While that was up more than 70%, it missed an average estimate for NT$29.1 billion.

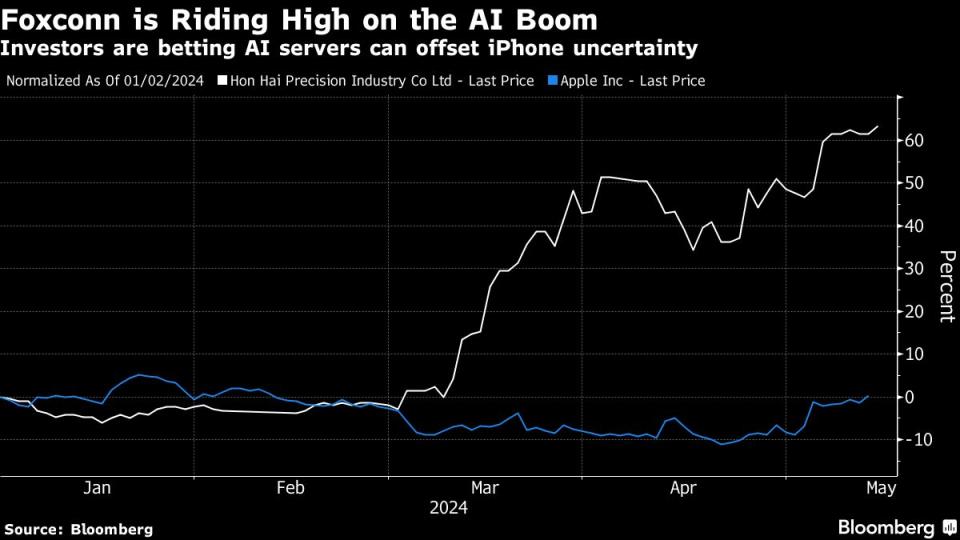

The miss reflects in part the heightened expectations around AI that helped propel Hon Hai’s shares more than 60% higher this year. It’s getting a boost from big investments into AI infrastructure such as datacenters. Company executives maintained the 40% growth outlook for the AI server business this year.

On Tuesday, Japanese subsidiary Sharp Corp. said it’s divesting its camera module and semiconductor business and turning a key display plant in Sakai into an AI datacenter.

Hon Hai’s AI business has proven a bright spot in an otherwise struggling operation that remains tied to the smartphone market. Investors hope booming AI demand could help the world’s largest iPhone assembler diversify its business away from Apple, which still accounts for more than half of Hon Hai’s sales.

Hon Hai, known also as Foxconn, indicated strong demand for cloud and networking products during the current quarter in presentation materials released before its earnings call. But revenue from consumer electronics should remain broadly flat.

Demand for iPhones fell about 27% in the first three months of 2024 in China, according to official government data, even though Apple said its iPhone business in the Asian nation grew. Hon Hai previously recorded a bigger-than-expected 9.6% slide in overall sales for the first quarter.

(Updates with AI server business outlook in the third paragraph)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

Milei Targets Labor Law That’s Set to Hand Banker $10 Million Severance

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance