Intel Corp's Dividend Analysis

A Comprehensive Look at Intel Corp's Dividend Sustainability and Future Prospects

Upcoming Dividend Details

Intel Corp (NASDAQ:INTC) recently announced a dividend of $0.13 per share, payable on June 1, 2024, with the ex-dividend date set for May 6, 2024. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. This analysis, supported by data from GuruFocus, will delve into the performance and sustainability of Intel Corp's dividends.

Company Overview

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

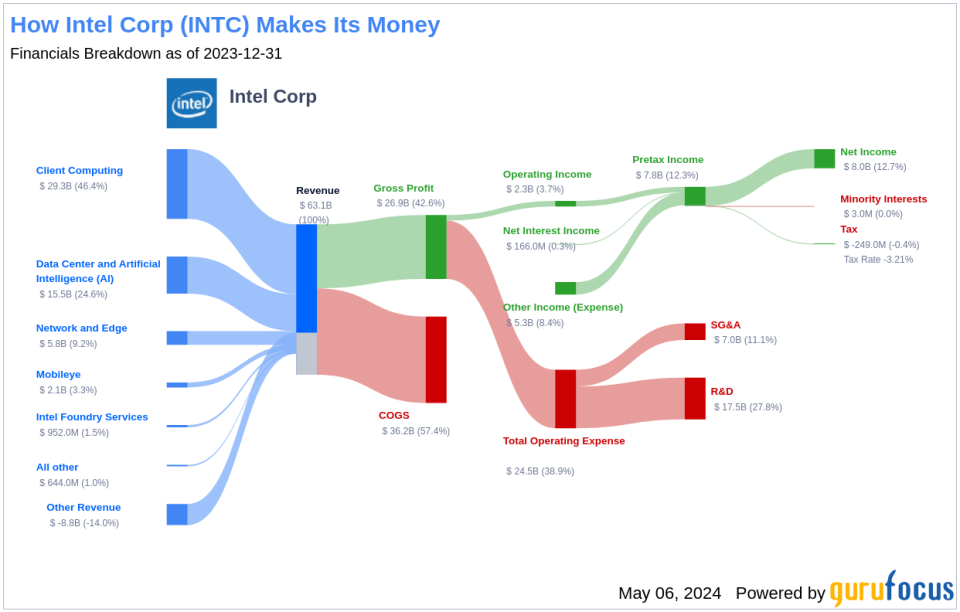

Intel Corp is a premier digital chipmaker, specializing in the design and manufacturing of microprocessors for the global personal computer and data center markets. The company pioneered the x86 architecture for microprocessors and has consistently led the market in semiconductor manufacturing advances, adhering to Moore's law. With a dominant market share in central processing units across PC and server end markets, Intel is expanding into new areas such as communications infrastructure, automotive, and the Internet of Things. Additionally, Intel aims to leverage its manufacturing prowess into an outsourced foundry model, producing chips for other entities.

Intel Corp's Dividend Track Record

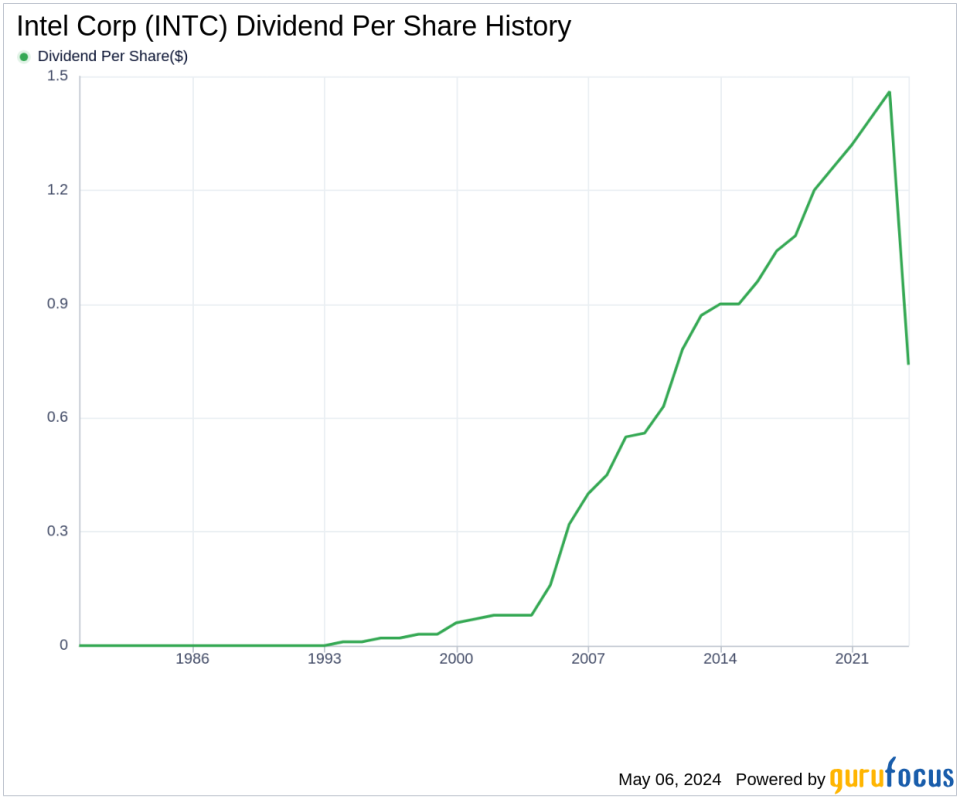

Intel Corp has consistently paid dividends since 1992, with distributions occurring on a quarterly basis. Below is a visual representation of the annual Dividends Per Share to help track historical trends.

Analysis of Dividend Yield and Growth

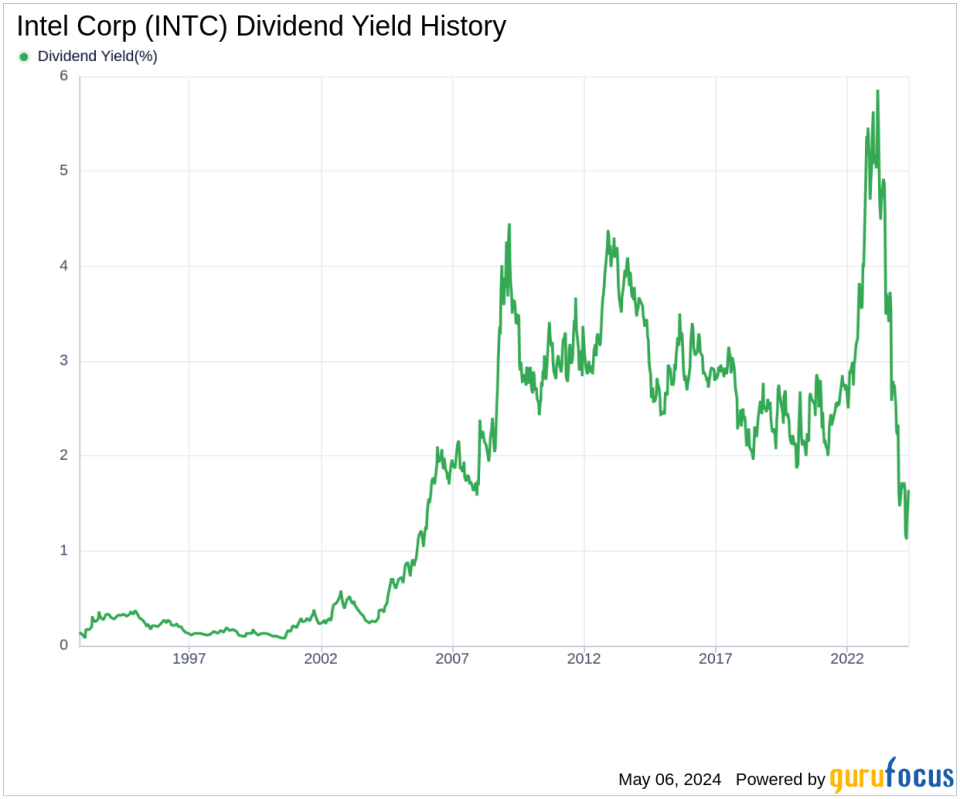

Currently, Intel Corp boasts a 12-month trailing dividend yield and a forward dividend yield of 1.62%, indicating stable expected dividend payments over the next year. Over the past three years, the annual dividend growth rate was -17.50%, improving to -5.40% over five years, and showing a long-term growth rate of 2.50% over the past decade. The 5-year yield on cost for Intel Corp stock is approximately 1.23%.

Evaluating Dividend Sustainability

To determine the sustainability of its dividends, it's important to consider Intel Corp's dividend payout ratio, which currently stands at 0.40. This ratio indicates that the company retains a substantial portion of its earnings, which supports future growth and buffers against potential downturns. Intel's profitability rank of 8 out of 10, combined with consistent positive net income over the past decade, underscores its strong profitability and financial health.

Future Growth Prospects

Intel Corp's robust growth rank of 8 suggests promising growth relative to its competitors. However, its revenue and earnings growth rates, along with a 5-year EBITDA growth rate of -26.10%, indicate challenges in outperforming global competitors. These metrics will be pivotal in assessing the long-term sustainability of Intel's dividend payments.

Conclusion and Next Steps

While Intel Corp's dividends appear sustainable based on its payout ratio and profitability, the company's growth metrics present some concerns. Investors should monitor these trends closely to gauge the future viability of regular dividends. For those interested in exploring further, GuruFocus Premium offers tools like the High Dividend Yield Screener to identify other high-yielding investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance