Home Sales Disappoint, DOE Inventories Support US Oil

Talking Points:

-US Existing Home Sales MoM (OCT) came in worse than expected at -3.2% vs. -2.9% expected and 1.9% prior

-US Existing Home Sales Total for October was 5.12M vs. 5.14M expected and 5.29M prior

-US Business Inventories for September beat estimates of 0.3% coming in at 0.6%

-August Business Inventories were revised higher from 0.3% to 0.4%

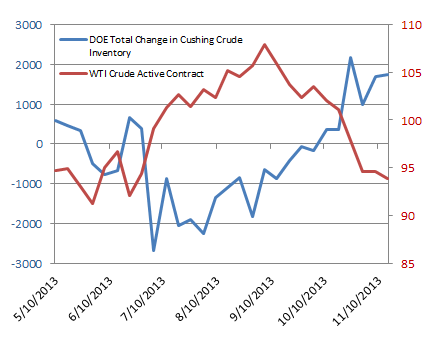

-U.S. Crude Oil Inventories (Nov 15) came in at 375K, much lower than the 1000K expected

After hitting over six year highs this past September, Existing Home Sales missed estimates of 5.14M to come in at 5.12M. The month over month reading came in at -3.2% vs. -2.9% while September Business Inventories beat estimates of 0.3% coming in at 0.6%. Although a disappointment, the 5.12M print is still one of the highest we’ve seen over the past few years.

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR) (5-Minute Chart)

Source: FXCM Marketscope

The Dow Jones FXCM Dollar Index was choppy following CPI and Advanced Retail Sales data at 13:30GMT and remained so following the home sales and business inventory prints. The index did see a surge as ECB comments of a -0.1% deposit rate prompted a steep decline in the Euro Look for event risk later today with minutes from the Oct 29-30 FOMC meeting being released at 19:00GMT.

As for the weekly crude inventory data, the DOE reported another strong number in Cushing, but overall U.S. Crude Oil Inventories came in at 375K vs. 1000K expected and 2640K prior. US Oil has been under pressure as inventory levels the past few weeks in Cushing have hit highs not seen since last year. If the commodity is to get any relief, a decrease in supply levels like we saw today will need to continue.

US Oil (5-Minute Chart)

Source: FXCM Marketscope

Gregory Marks, DailyFX Research Team

Keep up to date on event risk with the DailyFX Calendar.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance