Guest Commentary: Outlook on SNB Monetary Policy Assessment Statement

On December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to be washed out. With the recent Bundesbank expectations that growth in Germany will slow in 2013 and the expected weaker inflation in the eurozone, the SNB might even downgrade its inflation expectations for 2014, from values close to 1% down to 0.2%. These new estimations have already been announced by the Swiss statistics bureau.

Given that there are many upwards drivers of inflation, like immigration, huge money supply and rising housing prices, we think the central bank will not hike the floor. On the contrary, the SNB recently emphasized more and more the risks in their balance sheet: their main assets like German government bonds do not yield enough to cover potential FX losses. Recently, Credit Suisse and UBS announced negative interest rates for clearing clients that have high balances in francs. As has happened regularly before SNB meetings, FX traders go long EUR/CHF in the hope of a SNB move. The NZZ took these two pieces of news as the basis for speculating about a floor hike.

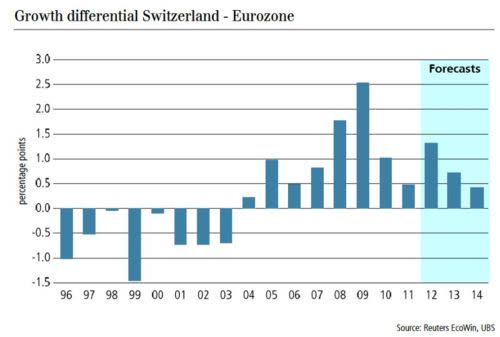

Most analysts expect stronger growth in Switzerland than in the euro zone in the coming years.

The Swiss economy has stabilized thanks to the introduction of the floor that helped to weaken the franc. Data from UBS and other sources suggest that thanks to deflation and cheaper production prices, in purchasing power terms and for the real effective exchange rate, the franc is not overvalued any more.

By George Dorgan, financial analyst and macro-based portfolio manager, http://snbchf.com

Would you like to see more third-party contributors on DailyFX? For questions and comments, please send them to research@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance