Forex: Japanese Yen Rebounds as European Leaders Scramble for Greek Deal

ASIA/EUROPE FOREX NEWS WRAP

High beta currencies and risk-correlated assets are only slightly weaker to start the last week of November, as a key Euro-zone finance ministers’ meeting is underway that will help determine the fate of Greece’s increasingly cumbersome debt burden. The schism that Greece faces between itself and the rest of Europe is substantial, with its debt-to-GDP ratio forecasted to hit 190% in 2014, while pan-European leaders aim to bring down the ratio to 120% over the next ten years or so (very open ended given the progress of reforms).

So far, what we know is that Greece remains due to receive €31 billion that was supposed to be released in May. But before these funds are released, finding an agreeable solution as to how to best fix Greece’s debt issues is the main concern; Euro-zone finance ministers and the International Monetary Fund have been negotiating for the past week on this very issue. The ramifications of a plan falling short of expectations could prove to be the final straw for Greece. Questions linger as to how much more the country can take in terms of exogenous political influence, a depressed economy, and widespread social unrest, before Greece moves to exit the Euro-zone. Certainly, with Alexis Tsipras’ anti-bailout Syriza party leading in recent polls by 26.0% to 21.5% over current Prime Minister Antonis Samaras’ pro-bailout New Democracy party.

While the Euro is mostly lower on the day, these concerns seem to have been nearly written off, or at least a favorable market outcome is being priced into the FX market. Meanwhile, a regional election in Spain over the weekend with a result implying diminished credibility for struggling Prime Minister Mariano Rajoy has underpinned weakness in European bond and equity markets, leading to a rebound in the safe haven currencies, the Japanese Yen and the US Dollar.

Taking a look at European credit, peripheral bond yields are mostly higher, keeping the Euro tempered on the day. The Italian 2-year note yield has increased to 2.012% (+5.0-bps) while the Spanish 2-year note yield has increased to 2.953% (+7.5-bps). Similarly, the Italian 10-year note yield has increased to 4.766% (+2.7-bps) while the Spanish 10-year note yield has increased to 5.621% (+4.4-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:40 GMT

JPY: +0.27%

GBP:-0.01%

CAD:-0.06%

NZD:-0.06%

EUR: -0.06%

CHF:-0.08%

AUD: -0.11%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.03% (-0.43% past 5-days)

ECONOMIC CALENDAR

There are no important data due out during today’s US trading session.

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EUR/USD: The pair is slightly lower today but remains near its November high, after breaking the confluence of resistance at 1.2800/40 (20-EMA, 50-EMA, 100-DMA, early-November high, mid-October swing low). As noted on Friday, “coupled with a breakout of the daily RSI above 50…the pair looks bullish again in the near-term.” Support comes in at 1.2800/40 and 1.2740/45. Resistance is 1.3015/20 (late-October high) and 1.3140/45.

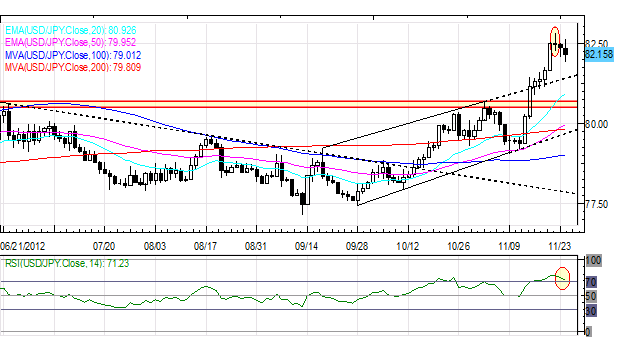

USD/JPY: While the Evening Star candle cluster has failed to materialize, the Doji / Shooting Star candle on Wednesday, when considered alongside the daily RSI starting to contract from its already-overbought levels, the USD/JPY looks near-term bearish. Support comes in at 81.75, 81.15, and 80.50/70 (former November high). Resistance is 82.90/83.00 and 83.30/55.

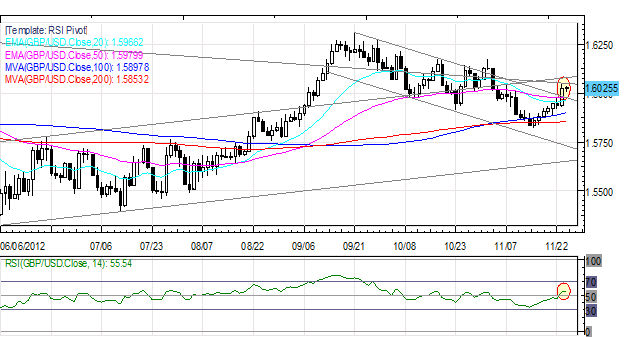

GBP/USD: Friday’s advance has brought the GBP/USD back into long-term trendline resistance, at 1.6035/55 (descending trendline resistance off of the April 2011 and April 2012 highs). This coincides with a potential break of the downtrend that’s been in place for the past two months, though a retest of former resistance at 1.5975 and ensuing bounce would strengthen the case for a run back towards 1.6300. Resistance comes in at 1.6170/80 (late-October highs). Support is 1.5965/75 (20-EMA, 50-EMA), 1.5895/1.5900 (100-DMA), and 1.5850/55 (200-DMA).

AUD/USD: No change: “More range-bound price action as the AUD/USD is wedged between rising trendline support and stubborn quarterly highs just below 1.0500. Accordingly, my levels remain unchanged. Support is at 1.0365/85 (trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is at 1.0405/50 (former swing highs and lows), 1.0475/80 (November high) and 1.0500/15.”

S&P 500: The rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) has carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA). A breakout above this area would suggest a more substantial rebound may yet be ahead. Support comes in at 1385 (200-DMA) and 1345/50 (November low). Resistance comes in at 1425 and 1460.

GOLD: Fresh November highs are in place after Friday’s rally, and with the US fiscal cliff/slope negotiations grinding slower, there may be some upside yet. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1755/58 and 1785/1805. Support is 1735, 1700, 1685/90 (100-DMA, November low), and 1660/65 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance