Earnings Season: 3 Companies Boosting Guidance

Guidance lifts commonly inject positivity into shares, with investors scrambling to get in and ride the momentum. Companies raise their outlooks when business is fruitful, sending a bullish message to shareholders.

Recently, several companies, including Coca-Cola KO, Eaton ETN, and Eli Lilly LLY, have raised their outlooks, with shares moving higher following the announcements.

For those interested in recent bullish activity, let’s take a closer look at each.

Coca-Cola

Beverage titan Coca-Cola posted EPS of $0.72, exceeding the Zacks Consensus EPS estimate by 4.5% and growing modestly on a year-over-year stack. Operating cash flow totaled $528 million, growing by a sizable $368 million from the year-ago period.

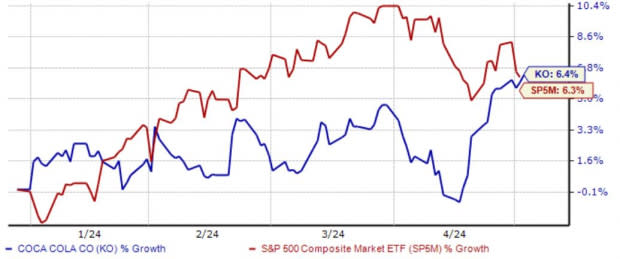

Following the release, KO updated its organic revenue guidance, expecting growth in a band of 8% - 9%. Shares have nearly matched the S&P 500 in 2024, gaining 6%.

Image Source: Zacks Investment Research

Eaton

Eaton posted EPS of $2.40, growing 28% year over year and reflecting a quarterly record. Sales totaled $5.9 billion, reflecting another quarterly record and improving 8% from the year-ago period. Impressively, segment margins reached 23.1%, another quarterly record and a 340-basis-point climb from the same period last year.

The company topped off the robust results with positive guidance, raising its outlook for organic growth, segment margins, and EPS. Shares have been considerably strong performers in 2024, gaining 36% and crushing the S&P 500.

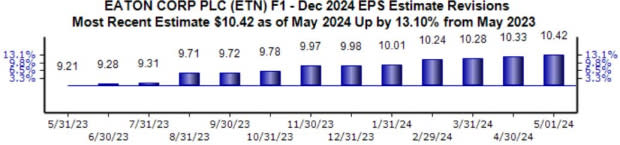

Analysts have positively revised their current year expectations, with the current $10.42 Zacks Consensus EPS estimate up 13% over the last year. The stock is a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Eli Lilly

Eli Lilly posted EPS of $2.58, beating our consensus EPS estimate by 2% and growing considerably from the $1.62 per share reported in the same period last year. Revenue throughout the period grew 26% year-over-year, driven by strong demand within Mounjaro, Zepbound, Verzenio, and Jardiance.

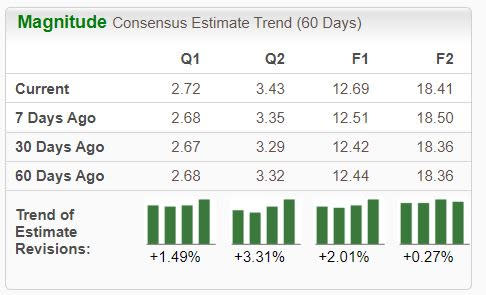

The results impressed investors, helping add to LLY’s positive price action year-to-date. LLY upped its full-year revenue guidance by $2 billion, further displaying the strong demand. The company’s earnings outlook has shifted higher across the board following the release.

Image Source: Zacks Investment Research

Bottom Line

Guidance lifts are among the most positive announcements shareholders can hear, injecting confidence in the long-term picture.

And recently, all three companies above – Coca-Cola KO, Eaton ETN, and Eli Lilly LLY – have raised their outlooks, with shares moving higher following the announcements.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance