ASX Growth Leaders With High Insider Ownership To Watch

The Australian market has shown promising growth, climbing 1.5% over the last week and achieving a 7.3% increase over the past 12 months, with earnings expected to grow by 13% per annum. In this buoyant environment, stocks with high insider ownership can be particularly compelling, as they often signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.9% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

DUG Technology (ASX:DUG) | 28.3% | 43.5% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Let's uncover some gems from our specialized screener.

Chrysos

Simply Wall St Growth Rating: ★★★★★☆

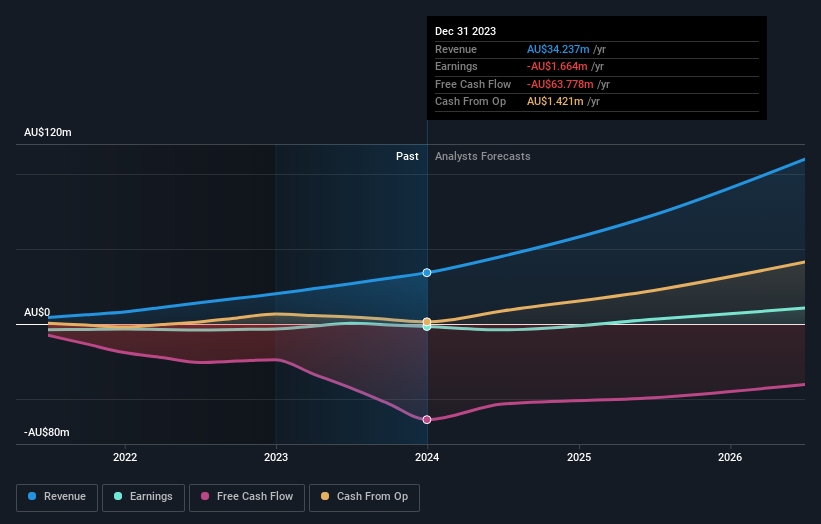

Overview: Chrysos Corporation Limited specializes in developing and supplying technology for the mining industry, with a market capitalization of approximately A$652.20 million.

Operations: The company generates its revenue primarily from mining technology services, totaling A$34.24 million.

Insider Ownership: 22.2%

Earnings Growth Forecast: 57.5% p.a.

Chrysos Corporation Limited, despite recent drops from the S&P/ASX Emerging Companies Index, demonstrates a strong growth trajectory with forecasted revenue increases of 33.5% per year, significantly outpacing the Australian market average. The company is expected to transition into profitability within three years, supported by an anticipated earnings growth of 57.46% annually. However, it's important to note that shareholder dilution occurred over the past year, and return on equity is projected to remain low at 8.3%.

Get an in-depth perspective on Chrysos' performance by reading our analyst estimates report here.

Our valuation report here indicates Chrysos may be overvalued.

Capricorn Metals

Simply Wall St Growth Rating: ★★★★★☆

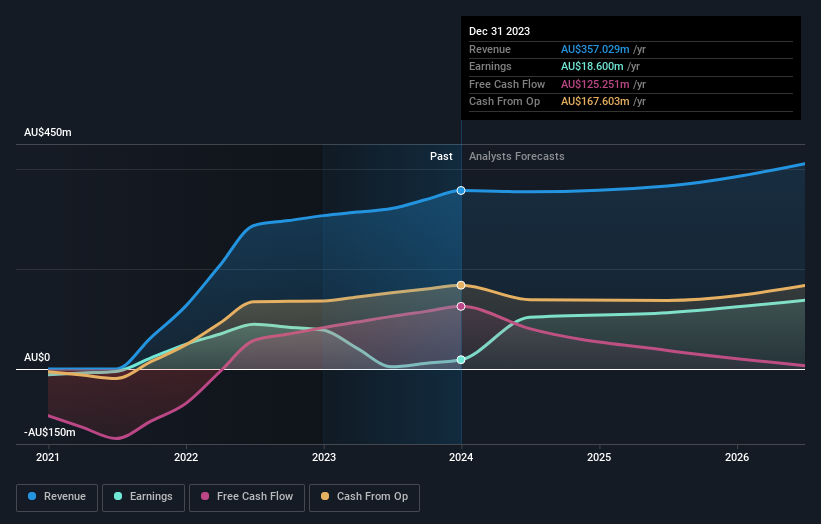

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties, with a market capitalization of approximately A$1.76 billion.

Operations: The company generates revenue primarily from its Karlawinda segment, amounting to A$356.94 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 28.7% p.a.

Capricorn Metals, with substantial insider buying activity over the past three months, reflects strong confidence from its management. The company reported a robust earnings growth of 28.71% per year, outperforming the Australian market average significantly. However, it faces challenges with declining profit margins from 25.4% to 5.2%. Despite these hurdles, Capricorn Metals is expected to maintain a high return on equity at 30.5% in three years, aligning with its aggressive growth projections in revenue and earnings.

IPD Group

Simply Wall St Growth Rating: ★★★★★☆

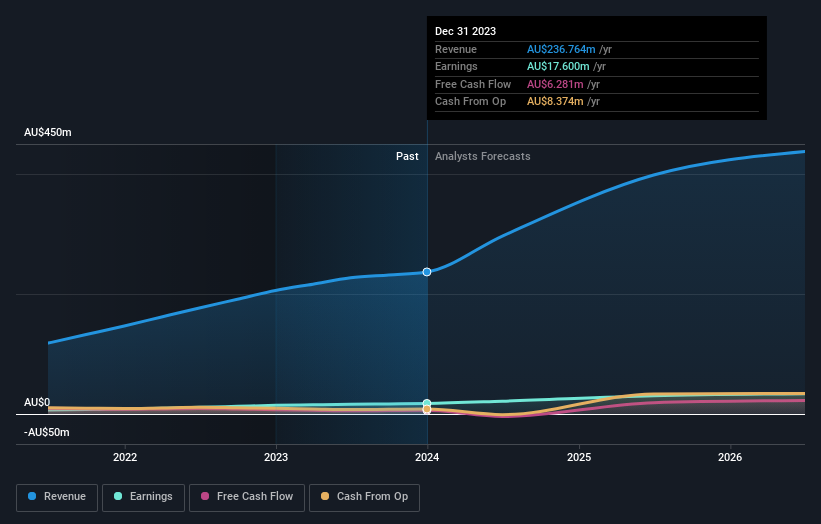

Overview: IPD Group Limited, operating in Australia, specializes in the distribution of electrical equipment and has a market capitalization of approximately A$455.91 million.

Operations: The company generates revenue through its Products Division, which brought in A$215.98 million, and its Services Division, which contributed A$20.79 million.

Insider Ownership: 28.4%

Earnings Growth Forecast: 26% p.a.

IPD Group is trading 14.5% below its estimated fair value, with analysts predicting a price increase of 28.6%. Despite shareholder dilution last year, the company has shown strong performance with earnings and revenue growth outpacing the Australian market average significantly. Over the past year, IPD's earnings increased by 22.4%, and it is forecasted to grow at an annual rate of 26% in earnings and 23.7% in revenue, although its Return on Equity is expected to remain low at 19.1%.

Make It Happen

Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 86 more companies for you to explore.Click here to unveil our expertly curated list of 89 Fast Growing ASX Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:C79ASX:CMM and ASX:IPG

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance