Associated Banc-Corp (ASB) Q1 Earnings Top as Fee Income Rises

Associated Banc-Corp’s ASB first-quarter 2024 earnings of 52 cents per share beat the Zacks Consensus Estimate of 49 cents. However, the bottom line compared unfavorably with the prior-year quarter’s earnings of 66 cents. The results in the reported quarter include the FDIC special assessment charge.

Results benefited from higher non-interest income and a rise in loans and deposit balance. However, a decline in net interest income (NII) and an increase in expenses and provisions were headwinds.

Net income available to common shareholders was $78.3 million, down 22% from the year-ago quarter. Our estimate for the metric was $73.7 million.

Revenues Decline, Expenses Rise

Net revenues (FTE basis) were $326.6 million, down 4% year over year. The top line also marginally missed the Zacks Consensus Estimate of $327.5 million.

NII was $253.4 million, down 6%. The net interest margin was 2.79%, down 28 basis points (bps) year over year. We had expected NII and net interest yield to be $259.2 million and 2.77%, respectively.

Non-interest income was $65 million, growing 5%. The rise was largely driven by higher wealth management fees, card-based fees and investment securities gains. Our estimate for the non-interest income was $61.2 million.

Non-interest expenses increased 5% to $197.7 million. These included the FDIC special assessment charge of $7.7 million. Excluding this, adjusted non-interest expenses were $190 million. Our estimate for non-interest expenses was the same as the reported number.

Adjusted FTE efficiency ratio was 57.25%, up from 54.64% in the prior-year quarter. A rise in the efficiency ratio indicates a deterioration in profitability.

As of Mar 31, 2024, total loans were $29.5 billion, up 1% sequentially. Total deposits also increased 1% to $33.7 billion.

Credit Quality Worsens

In the reported quarter, the company recorded a provision for credit losses of $24 million, jumping 34% from the prior-year quarter. Our estimate for the metric was $28.2 million.

As of Mar 31, 2024, total non-performing assets were $188 million, surging 42%. Total non-accrual loans were $178.3 million, rising 52%.

Net charge-offs were $30 million, up substantially from $5 million in the prior-year quarter.

Capital Ratios Deteriorates

As of Mar 31, 2024, Tier 1 risk-based capital ratio was 10.02%, down from 10.05% recorded in the corresponding period of 2023. The common equity Tier 1 capital ratio was 9.43%, down from 9.45%.

Share Repurchase Update

During the reported quarter, Associated Banc-Corp repurchased 0.9 million shares.

2024 Outlook

Management expects loan growth of 4-6%.

Total core customer deposits are estimated to rise 3-5%.

NII is projected to increase 2-4%.

After adjusting to exclude the impact of non-recurring items related to the balance sheet repositioning announced in the fourth quarter of 2023, total non-interest income is expected to remain stable or decrease 2%.

After adjusting to exclude the impact of the FDIC special assessment, total non-interest expenses are anticipated to rise 2-3%.

The effective tax rate is expected to be 19-21%.

Our Take

Associated Banc-Corp’s business-restructuring efforts are likely to keep supporting financials. The company has a solid balance sheet position, making it well-poised for growth. However, elevated expenses and provisions are likely to hurt profits in the near term.

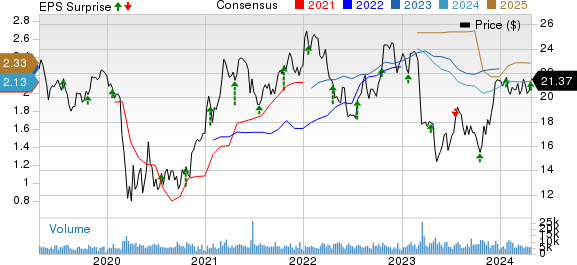

Associated Banc-Corp Price, Consensus and EPS Surprise

Associated Banc-Corp price-consensus-eps-surprise-chart | Associated Banc-Corp Quote

ASB currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

East West Bancorp, Inc.’s EWBC adjusted earnings per share of $2.08 in the first quarter of 2024 surpassed the Zacks Consensus Estimate of $2.00. However, the bottom line declined 10.3% from the prior-year quarter.

EWBC’s results were primarily aided by an increase in non-interest income. Also, deposit balances increased sequentially in the quarter. However, lower NII and higher expenses and provisions were the undermining factors.

Webster Financial’s WBS first-quarter 2024 adjusted quarterly earnings per share of $1.35 missed Zacks Consensus Estimate of $1.37. This compares unfavorably with earnings of $1.49 per share reported a year ago.

Results were affected by a fall in both NII and deposit balances, along with elevated expenses. However, lower provisions and a rise in loan balances acted as tailwinds for WBS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Webster Financial Corporation (WBS) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance